With the right legal invoicing software, you can say goodbye to law firm billing disputes and hello to smoother client interactions.

The way a law firm handles its finances can make or break its success. Efficient legal payment management isn’t just about keeping the books balanced – it’s about ensuring a steady cash flow, boosting client satisfaction, and freeing up time for what really matters: practicing law.

Let’s dive into the world of legal payment management and explore how modern tools can transform your firm’s financial operations, leaving outdated methods in the dust.

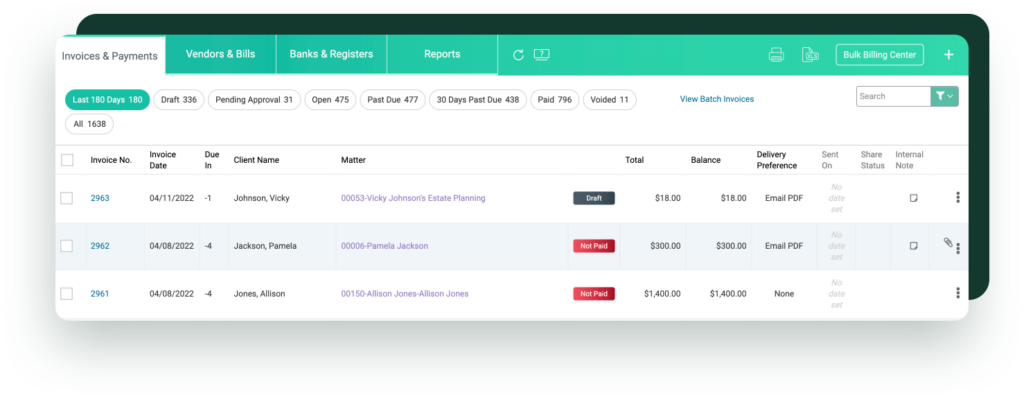

Streamlined Billing and Invoicing

Picture this: no more law firm billing headaches, fewer payment delays, and happier clients. That’s the power of a smooth billing process. When your invoices are clear, professional, and transparent, you’re not just asking for payment – you’re building trust. Clients appreciate knowing exactly what they’re paying for, and this transparency goes a long way in strengthening relationships. With the right legal invoicing software, you can say goodbye to law firm billing disputes and hello to smoother client interactions.

Remember the days of manually typing up invoices, printing them out, and mailing them to clients? Not only was this time-consuming, but it also led to delays in payment and increased the risk of errors. Modern legal payment management systems automate this process, allowing you to generate and send accurate, professional invoices in minutes, not hours.

Optimized Timekeeping

Every minute counts in the legal world, and accurate time tracking is the unsung hero of profitability. For lawyers and paralegals alike, having reliable tools to record billable hours is crucial. Modern time-tracking tools integrate seamlessly with billing systems, turning hours worked into accurate invoices with just a few clicks. But it’s not just about tracking billable hours. By keeping tabs on non-billable time too, you can optimize your firm’s efficiency and boost overall profitability. It’s about working smarter, not harder.

The impact of efficient time tracking and task management can be dramatic. Take it from Hannah Stitt of Tectonic, LLP, who experienced a significant improvement in their workflow:

“Before using CARET Legal, seven hours elapsed from the time we initially saw a lead to a signed retainer,” says Stitt. “But once we used custom intake forms to populate CARET Legal as well as a task template, the firm reduced that time to 2.5 hours.“

This remarkable reduction in lead-to-retainer time demonstrates how the right tools can transform your firm’s efficiency. By streamlining processes and automating routine tasks, you can free up valuable time to focus on what matters most – serving your clients and growing your practice.

Embracing Modern Legal Payment Processing

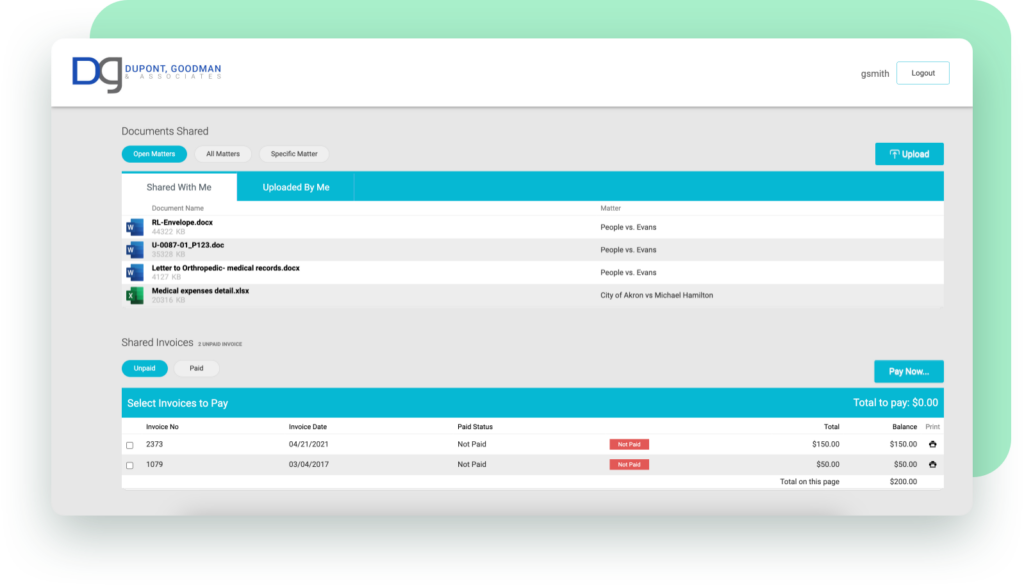

In an age where people pay for coffee with their smartphones, law firms need to keep up. Offering a variety of payment options – from credit cards to ACH transfers and eChecks – isn’t just convenient; it’s expected. By integrating secure online payment systems, you’re not only making life easier for your clients but also speeding up your collections.

Secure client portals play a crucial role in modern legal payment processing. Law firm clients can view and pay invoices with the click of a button. This level of accessibility and security significantly enhances the client experience, leading to improved satisfaction and faster payments.

And let’s not forget the power of flexible payment plans. They can be a game-changer for client retention, making your services more accessible and fostering long-term relationships. Gone are the days when law firms only accepted checks or cash. This limited approach often led to payment delays and administrative headaches. With modern payment processing systems, clients can pay instantly online, dramatically reducing the time between invoicing and receiving payment. Plus, automated reconciliation means no more manual data entry or bank trips to deposit checks.

From precise billing to trust accounting compliance, and from flexible payment options to insightful analytics, each piece of the puzzle plays a crucial role in your firm’s financial health.

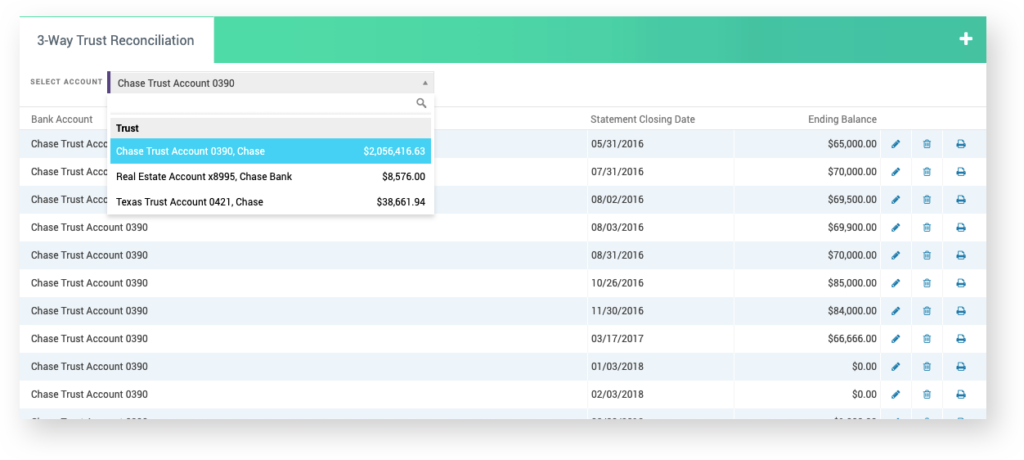

Navigating Trust Accounting Compliance

Trust accounting might not be the most exciting part of law, but it’s certainly one of the most critical. Staying compliant with IOLTA regulations isn’t just good practice – it’s essential for your firm’s integrity and legal standing.

IOLTA, which stands for Interest on Lawyers Trust Accounts, is a method to provide legal services for indigent persons by raising money for charitable purposes. IOLTA accounts are a type of lawyer trust account for client funds that are “nominal in amount” or expected to be held for a “short period of time.” Compliance with IOLTA regulations is crucial to avoid ethical violations and potential legal consequences. Given the complexity and importance of IOLTA compliance, many law firms find themselves struggling with the intricacies of trust accounting. This is where the right legal payment management software can be a lifesaver. It helps you track trust funds and client deposits with precision, minimizing the risks associated with mishandling client funds. In the world of trust accounting, an ounce of prevention is worth a pound of cure.

For instance, tools like CARET Legal offer features specifically designed for trust accounting, including:

- Automated three-way reconciliation reports

- Real-time trust account balance tracking

- Notifications for low trust account balances

- Detailed audit trails for all trust account transactions

These features help ensure that your firm stays compliant with IOLTA regulations and maintains the highest standards of financial integrity, all while simplifying what can otherwise be a complex and time-consuming process.

The Power of Reporting and Analytics

In the data-driven world we live in, detailed financial reporting isn’t just nice to have – it’s a necessity. The ability to track payment trends, monitor revenue growth, and keep an eye on overdue accounts gives you a bird’s-eye view of your firm’s financial health.

Real-time financial insights help you identify and address bottlenecks in your cash flow quickly. Plus, with the right analytics, you can make informed decisions about everything from retainer fees to billing schedules, optimizing your payment structures for maximum efficiency.

The Integration Advantage

In the modern law firm, payment management doesn’t exist in a vacuum. Integrating it with your broader practice management tools creates a seamless operational flow. When your case management, billing, and payment systems talk to each other, you’re not just saving time – you’re opening up new possibilities for efficiency and insight. A unified platform means less time juggling different systems and more time focused on what you do best: serving your clients and growing your practice.

Embracing the Future of Legal Payment Management

As we’ve seen, effective legal payment management is a multifaceted challenge that requires a comprehensive solution. From precise billing to trust accounting compliance, and from flexible payment options to insightful analytics, each piece of the puzzle plays a crucial role in your firm’s financial health.

This is where CARET Legal shines, offering an all-in-one platform that addresses these critical needs:

- Advanced billing features, including pre-billing review and split billing

- Multiple time tracking options for pinpoint accuracy

- Integrated payment processing with various client-friendly options

- Robust trust accounting tools to keep you IOLTA-compliant

- Secure portal where clients can view and pay invoices

- Comprehensive reporting and analytics for data-driven decisions

- Seamless integration with broader practice management tools

By embracing CARET Legal, you’re not just adopting software – you’re revolutionizing your firm’s financial operations. Imagine significantly reduced administrative work, improved cash flow, and enhanced client satisfaction.

The future of legal payment management is here, and it’s time for your firm to take the leap. Ready to transform your firm’s financial landscape, optimize your operations, and gain a competitive edge in today’s legal world? Schedule a demo of CARET Legal today. Your future self – and your clients – will thank you!