Regularly checking in on your payment trends, arming yourself with the right tools, and getting your team on board can work wonders for your firm’s financial health.

Understanding your law firm’s financial health lies in identifying and analyzing payment trends. Payment trends refer to patterns in how and when clients pay for legal services. These patterns can include the timing of payments, the consistency of full or partial payments, and any recurring issues with delayed or missed payments.

The role of data analysis in revealing these trends cannot be overstated. By leveraging modern payment technology and analytics tools, law firms can gain a comprehensive view of their financial performance. This analysis enables informed decision-making and the implementation of strategic improvements that can significantly impact your firm’s bottom line. Let’s explore the common trends you should be looking for and how they can inform your financial strategy.

Common Payment Trends to Look For

When examining your law firm’s payment patterns, there are three primary trends you should be aware of — prompt payments, delayed payments, and partial payments. These provide unique insights into your firm’s financial health and client relationships.

Prompt payments received within the agreed-upon timeframe (typically within 30 days of invoicing), are the ideal scenario. A high percentage of prompt payments indicates not only a healthy cash flow but also efficient billing processes and strong client relationships. It suggests that your clients value your services and prioritize timely payment, which can be a reflection of their satisfaction with your work.

Delayed payments occur when clients fail to pay within the agreed-upon timeframe. While occasional delays are normal, especially with larger corporate clients who may have complex approval processes, a pattern of delayed payments can signal potential issues. These might include issues with your billing process, such as unclear invoices or inconsistent follow-ups. It could also indicate challenges in your client relationships, such as dissatisfaction with services or poor communication.

Partial payments happen when clients pay only a portion of the invoiced amount. This could be due to various reasons, such as disputed charges, financial difficulties on the client’s part, or misunderstandings about the billing agreement. While partial payments are better than no payment at all, they can complicate your accounting processes and impact your cash flow. They may also indicate a need for clearer communication about your services and billing practices.

How to Determine What Impacts These Trends

To gain a comprehensive understanding of your payment trends, examine the underlying metrics that influence them. There are a few in particular that can provide valuable insights into why certain payment patterns emerge.

- Billable hours are the cornerstone of most law firms’ revenue. Tracking billable hours can help you understand the relationship between the work performed and the payments received. For instance, if you notice a discrepancy between high billable hours and low prompt payments, it might indicate issues with your billing efficiency or client communication. It could also suggest that you’re taking on time-consuming cases that aren’t translating into timely revenue.

- The realization rate is another metric representing the percentage of billable time that is actually invoiced to clients. A low realization rate could lead to delayed or partial payments, as clients might dispute charges for time they weren’t expecting to be billed. This metric can help you identify inefficiencies in your work processes or issues with your billing practices.

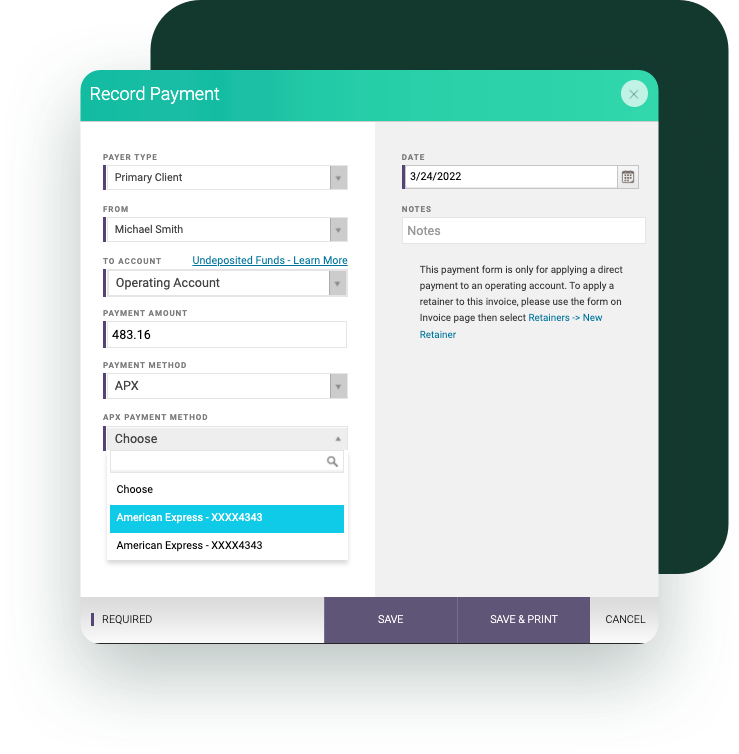

- Collection efficiency measures how quickly you convert billed time into received payments. Low collection efficiency often correlates with higher rates of delayed payments. This metric can help you identify bottlenecks in your billing and collection processes. For instance, if your collection efficiency is low, you might need to implement more rigorous follow-up procedures for unpaid invoices or consider offering alternative payment methods to make it easier for clients to pay promptly.

Consider a case where your billable hours are high, but your realization rate is low, and your collection efficiency is poor.

This could indicate that while you’re putting in a lot of work, you’re writing off significant time before invoicing (low realization rate), and then struggling to collect on the invoices you do send out (poor collection efficiency). This combination could lead to cash flow issues despite a seemingly busy practice.

While understanding these metrics is important, manually tracking and analyzing them can be time-consuming and prone to error. This is where advanced technology comes into play, offering a more efficient and accurate way to monitor your firm’s financial health.

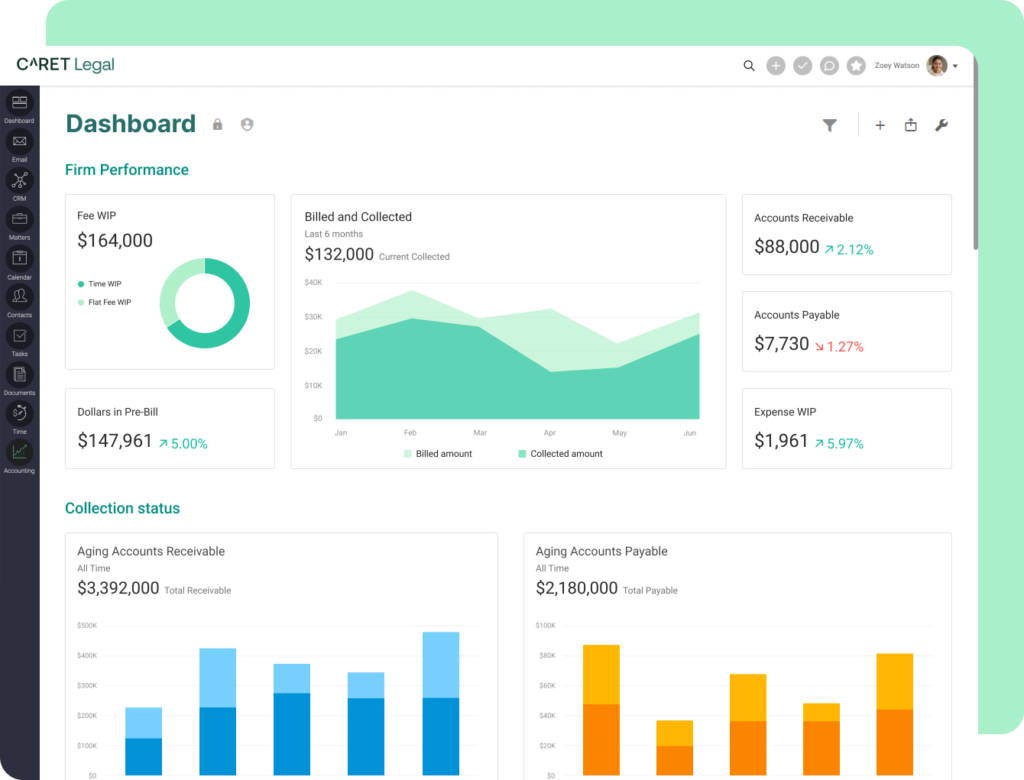

Legal practice management tools not only help identify trends but also measure and analyze the metrics related to those trends.

How Legal Practice Management Software Aids in Payment Trend Discovery & Analysis

Legal practice management software (LPMS) has revolutionized the way law firms handle their financial data. These powerful tools not only help identify trends but also measure and analyze the metrics related to those trends, providing a level of insight that was previously difficult, if not impossible, to achieve manually.

One of the primary benefits of LPMS is its ability to automatically track crucial data points such as billable hours, realization rates, and collection efficiency. This automation eliminates the need for manual data entry, significantly reducing errors and saving time. More importantly, it ensures that you have a constant, real-time view of your firm’s financial performance.

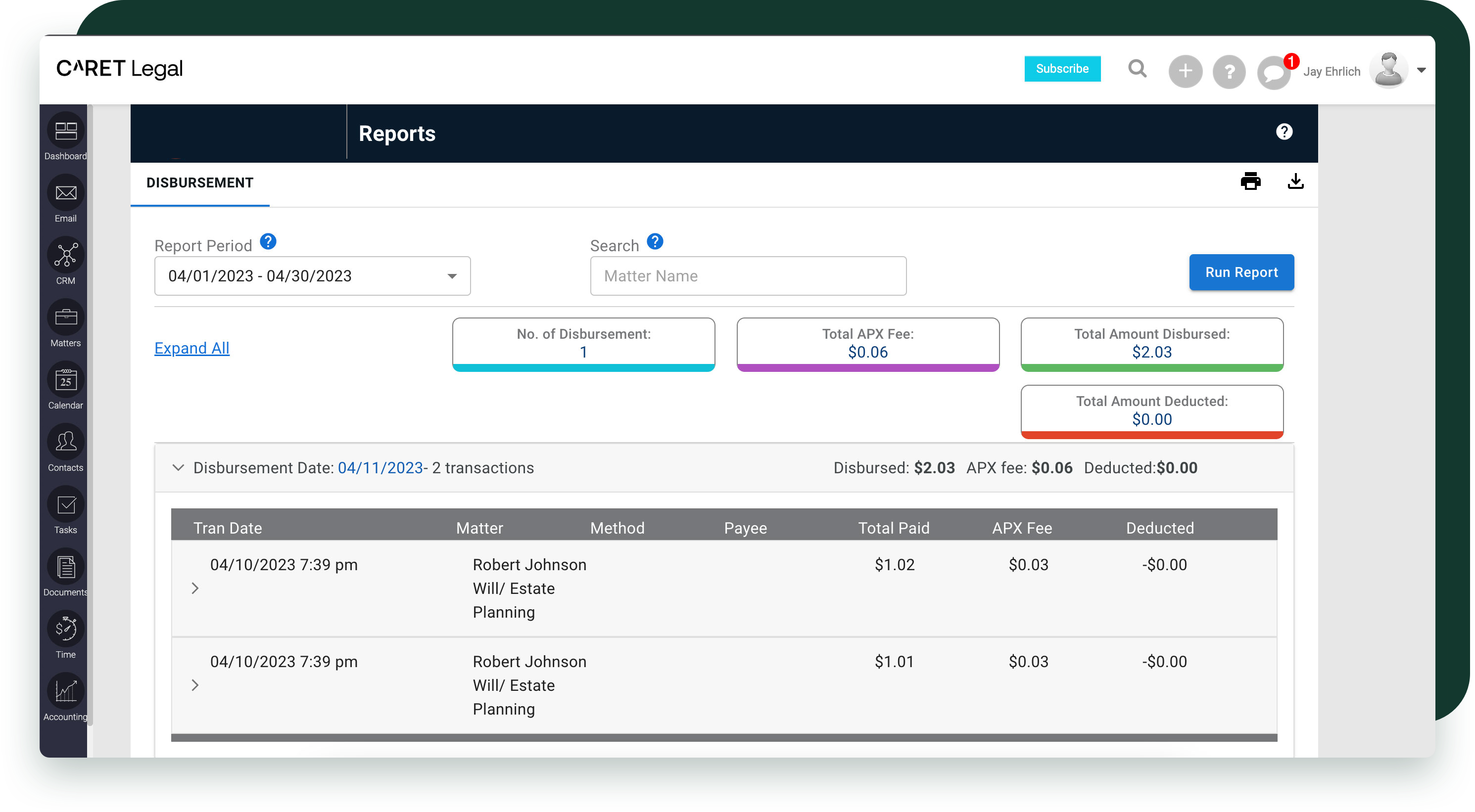

Law firm practice management software tracks data in various ways. For billable hours, it often integrates with time-tracking tools, allowing attorneys to log their time directly into the system. For realization rates, the software compares the time logged against the time actually billed, automatically calculating the rate. Collection efficiency is tracked by monitoring invoice dates against payment receipt dates. Some advanced LPMS systems even use AI to analyze billing descriptions and suggest appropriate billing codes, improving accuracy and consistency in data tracking.

The reporting capabilities of LPMS are particularly valuable for trend analysis. These systems can generate detailed reports that allow you to visualize your data and spot trends more easily. You might, for example, be able to create a report that shows payment patterns over time, broken down by practice area, client type, or individual attorney. This level of granularity can reveal insights that might not be apparent from looking at aggregate data alone.

With LPMS, you can easily identify specific trends that can inform your financial strategy. Seasonal payment fluctuations, for instance, can be clearly mapped out, allowing you to prepare for periods of lower cash flow. You might discover that certain practice areas experience slower payments during particular months, allowing you to adjust your budgeting and resource allocation accordingly.

The insights provided by LPMS are not just valuable for understanding your current financial situation; they also play a crucial role in predicting future financial patterns and planning accordingly.

Using Payment Trends for Financial Forecasting

Once you’ve identified your payment trends you can leverage this information for financial forecasting. This process involves analyzing historical data to predict future behavior, considering seasonality, accounting for client-specific trends, and using trend data to project cash flow more accurately.

Start by looking at payment patterns over the past several years. Are there consistent trends? Do certain months consistently show higher or lower payment rates? This historical view can provide a baseline for your forecasts. Next, factor in seasonal fluctuations. Many law firms experience seasonal variations in both workload and payments. By accounting for these seasonal trends, you can create more accurate month-to-month forecasts and better prepare for periods of lower cash flow.

Use your payment trend data to project cash flow more accurately. For example, if you notice that a particular client consistently pays 45 days after invoicing instead of the standard 30 days, you can factor this into your cash flow projections. This more precise forecasting can help you make better decisions about expenses, hiring, and investments.

For instance, if your data shows that corporate clients in the manufacturing sector typically pay within 45 days in the first quarter but extend to 60 days in the fourth quarter, you can adjust your cash flow projections accordingly. This might mean planning major expenses or hires for early in the year when cash flow is stronger.

External factors can significantly impact payment trends and should be considered in your forecasting. For example, during an economic downturn, you might notice that clients in certain industries take longer to pay or request extended payment terms. Conversely, in a booming economy, you might see faster payments and fewer requests for discounts. Legal changes, such as new regulations in a particular industry, could also affect payment patterns as clients adjust their budgets to accommodate compliance costs.

While forecasting helps you prepare for potential financial challenges, it’s equally important to take proactive steps to address payment issues as they arise.

How to Mitigate Late Payments and Non-Payments

Understanding payment trends and forecasting potential issues is crucial, but taking action to improve these trends is equally important. Mitigating late payments and non-payments requires a multi-faceted approach that combines clear policies, effective communication, and strategic use of technology.

To identify late payments and non-payments:

- Implement a color-coded aging report system within your legal practice management software. For example, invoices 1-30 days past due could be yellow, 31-60 days orange, and over 60 days red. Regular review of these tools will help quickly identify payment issues.

- Create clear payment terms. Ensure your clients understand when and how they’re expected to pay from the outset of your engagement. This information should be clearly stated in your engagement letter and reiterated in your invoices. Consider discussing payment expectations during your initial client meeting to avoid any misunderstandings later on.

- Maintain a professional and understanding tone when discussing payment issues with clients. Remember, your goal is to resolve the issue while preserving the client relationship. Listen to your client’s concerns and be prepared to offer solutions. For instance, you might consider offering payment plans for clients experiencing temporary financial difficulties.

While addressing payment issues is important, it’s equally crucial to recognize and capitalize on positive payment trends to drive your firm’s growth.

Use your payment trend data to project cash flow more accurately. This more precise forecasting can help you make better decisions about expenses, hiring, and investments.

Leveraging Positive Payment Trends for Firm Growth

Positive payment trends are not just good news—they’re opportunities for growth. By identifying and capitalizing on these trends, you can create a virtuous cycle of financial stability and practice expansion.

Start by identifying your most reliable payers. These clients are the bedrock of your firm’s financial stability, and they deserve special attention. Consider offering these clients additional services or seeking referrals from them. They’ve demonstrated their value to your firm through their prompt payments, and they’re likely to be satisfied with your services.

Analyze what makes these clients different. Is it the type of work you do for them? Your billing practices? The way you communicate? Use these insights to improve relationships with other clients and to inform your client acquisition strategies. For example, if you notice that clients in a particular industry tend to be prompt payers, you might consider focusing your marketing efforts on attracting more clients from that industry.

To reinforce positive payment trends, consider implementing a client loyalty program. For instance, offer a 5% discount on the next matter for clients who consistently pay within 15 days of invoicing. Another strategy is to provide premium services, such as quarterly legal updates or priority scheduling, to your most reliable payers.

The stable cash flow from prompt payers provides an opportunity for strategic reinvestment in your firm. Consider using these funds to drive growth through technology investments, talent acquisition, marketing initiatives, or professional development. By reinvesting in your firm, you can create a cycle of growth. Improved technology and expanded capabilities can lead to better service delivery, which in turn can result in higher client satisfaction and more prompt payments.

Incorporate positive payment trends into your financial planning by allocating a percentage of early payments to an investment fund for firm growth initiatives. This approach not only improves your current financial situation but also sets the stage for long-term success and expansion in an increasingly competitive legal marketplace.

Financial Success Starts Here

Let’s face it: understanding your firm’s payment trends is a game-changer. It’s like having a financial crystal ball, giving you insights into cash flow, client behaviors, and areas where you can really shine. By getting to grips with these trends, you’ll be making smarter decisions that benefit your firm both now and in the long run.

We’re big believers in the power of data, and we think you should be too. Regularly checking in on your payment trends, arming yourself with the right tools, and getting your team on board can work wonders for your firm’s financial health.

Feeling inspired to take your firm’s financial insights to the next level? We’d love to show you how CARET Legal can help. Schedule a demo with us and see firsthand how our practice management software can help your firm thrive. Let’s make those payment trends work for you!