How Can Reducing Non-Billable Hours Make Good Legal Firms Better?

If your firm is willing to adopt new technology and upgrade automation tools, you will save time, reduce errors, and improve the firm’s bottom line.

Leave standalone software behind

Manage all your cases in one place

Simplify repetitive tasks

Gather insights into your firm's performance

Increase billable time and cashflow

Manage your documents

Reach and collaborate with your clients

Grow your client list

Read all about the latest industry topics

Learn from industry experts

In-depth legal insights

Real perspectives from real people

See an extensive list of CARET Legal partners

Join CARET Legal's partnership program today

Stay up-to-date on all things legal technology, including practice management, payments, automation, and more.

If your firm is willing to adopt new technology and upgrade automation tools, you will save time, reduce errors, and improve the firm’s bottom line.

Every year, we look forward to heading to Chicago for ABA TECHSHOW to join fellow tech-enthusiasts for new product announcements, informative sessions and panel discussions, and networking with partners, colleagues and clients. Despite this year’s conference being held virtually, we are still excited to share a few of the over

Congratulations! You have decided, either as an individual or with a group of colleagues, to open your own law firm. There is a lot to do and many choices to be made. Everything from office location, firm name, domain name, business cards, internet and phone services to computers (Windows or

Law firms work with dozens, or even hundreds, of different vendors each month. Without the right tools, tracking all of the contracts, invoices and tax information for these companies can be a full time job. CARET Legal’s robust vendor management tools help firms efficiently manage all invoices and outgoing payments

In many firms, “succession planning” is important, but not urgent. It is human nature to deal with tactical issues and delay any strategic initiatives, but many professionals do not have an end-goal in mind. Many believe that they will “die at their desks.” However, no one can remain in a

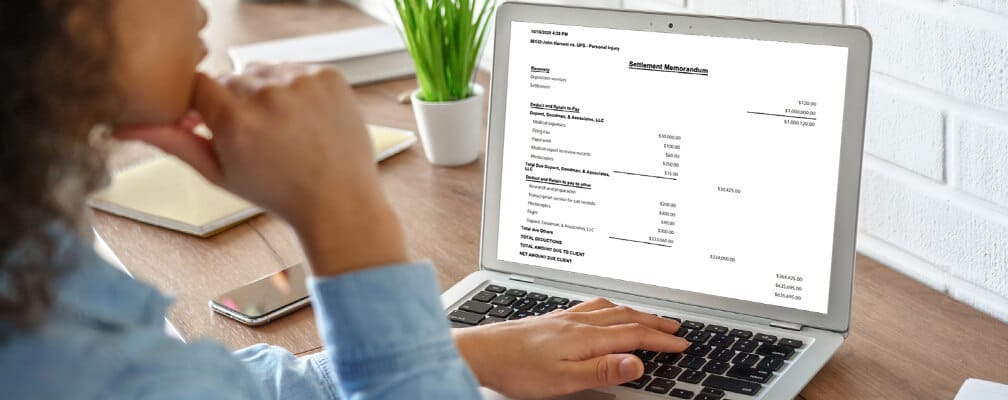

Personal injury cases are complex and so, too, are the workflows involved in managing them. CARET Legal’s Suite’s end-to-end practice management platform is loaded with specialized tools that help personal injury firms streamline processes, increase productivity and maximize profitability. CARET Legal’s Settlement Management tools enable firms to efficiently manage settlement

Each year, the CARET Legal development team releases hundreds of updates and dozens of new features to help law firms be more efficient and profitable. While it can be difficult to narrow down our list of favorites, CARET Legal users have spoken, and based on their feedback, we’re pleased to

Keeping track and recording billable time, especially after the fact, is time consuming. A law firm with attorneys, paralegals, and an administrative support staff might even spend too much time (and money) filling out billable time sheets and sending paper records to accounting. That’s where time and billing software can

It may not feel like it, but the end of the year is fast approaching! Between running reports for shareholders, generating 1099s for every vendor, and figuring out employee bonuses, there can be a lot to deal with and you don’t want to be scrambling to do it all at

Receive updates from the CARET Legal team right in your inbox. We’ll curate valuable insights, tips, and resources to help you navigate the future of the legal industry.

Leave standalone software behind

Manage all your cases in one place

Simplify repetitive tasks

Gather insights into your firm’s performance

Increase billable time and cashflow

Manage your documents

Reach and collaborate with your clients

Grow your client list

Read all about the latest industry topics

Learn from industry experts

In-depth legal insights

Real perspectives from real people

See an extensive list of CARET Legal partners

Join CARET Legal’s partnership program today

|

CARET Legal is proudly recognized as "Cloud-based Practice Management Platform of the Year" by the 2025 LegalTech Breakthrough Awards. |