Developing robust conflict check systems is crucial, as is leveraging modern tools like legal practice management software (LPMS) to effectively navigate challenging waters

Developing robust conflict check systems is crucial, as is leveraging modern tools like legal practice management software (LPMS) to effectively navigate challenging waters

Insurance defense firms navigate a unique legal landscape, fraught with potential conflicts of interest. The intricate relationships between insurers, insured parties, and defense attorneys create a complex web of responsibilities and loyalties. This complexity is further magnified by the fact that approximately 80% of civil litigation in the United States involves liability insurance, introducing multiple layers of issues beyond those explicitly stated in legal pleadings.

In this high-stakes environment, insurance defense attorneys must be adept at identifying and managing common conflict scenarios. Developing robust conflict check systems is crucial, as is leveraging modern tools like legal practice management software (LPMS) to effectively navigate these challenging waters. By mastering these elements, insurance defense firms can maintain ethical standards, protect their clients’ interests, and operate more efficiently in an increasingly complex legal landscape.

Understanding the Tripartite Relationship and Common Conflict Scenarios

The tripartite relationship in insurance defense creates a unique set of challenges and potential conflicts. To effectively navigate these waters, it’s crucial to understand the nuances of this relationship and the various scenarios where conflicts commonly arise.

The Tripartite Relationship and Its Challenges

In insurance defense, the tripartite relationship between insurer, insured, and attorney involves balancing duties to the insured while adhering to the insurer’s control over the defense. The way this relationship is interpreted varies by state:

- Alabama: Both the insurer and insured are considered clients, potentially complicating matters when their interests conflict [Mitchum v. Hudgens, 533 So.2d 194, 198 (Ala. 1988)].

- Arizona: The primary client can be either the insurer or insured, depending on the situation, giving flexibility but requiring careful navigation [Paradigm Ins. Co. v. Langerman Law Offices, 24 P.3d 593, 602 (Ariz. 2001)].

- Texas: The insured is seen as the sole client, simplifying the relationship but adding responsibility for communicating with the insurer [Safeway Managing General Agency, Inc. v. Clark & Gamble, 985 S.W.2d 166, 168 (Tex.App.-San Antonio 1998)].

| State | Primary Client | Implications |

| Alabama | Both Insurer & Insured | Conflicts arise more easily |

| Arizona | Situational | Flexible but complex |

| Texas | Insured only | Greater responsibility for counsel |

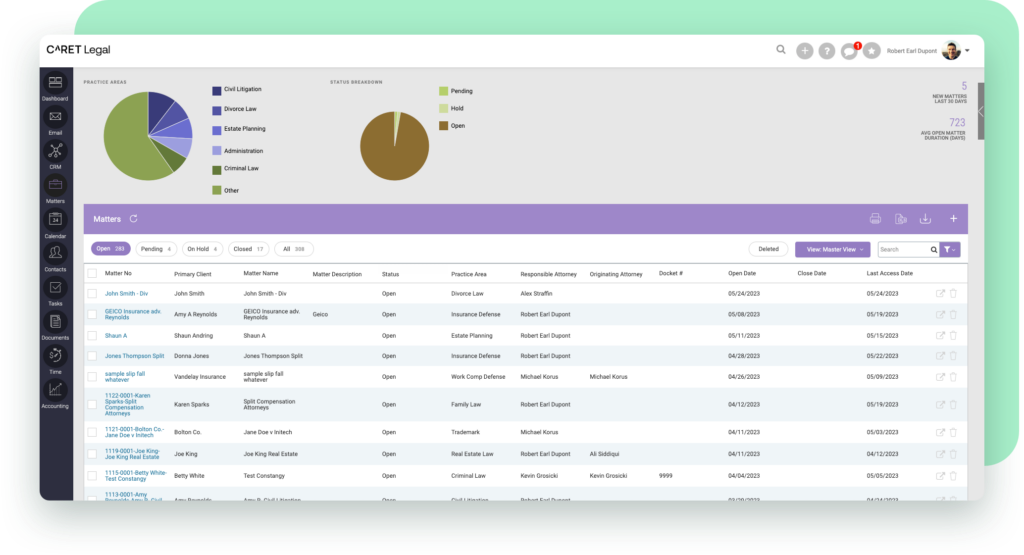

Understanding these local distinctions is critical for navigating the responsibilities and conflicts inherent in insurance defense work. Modern LPMS solutions offer features designed to navigate these complex relationships. For instance, advanced matter management dashboards can provide a bird’s eye view of financials, activity, and progress in each case, helping you keep track of the various aspects of your matters. CARET Legal’s matter management feature, for example, allows you to customize matter views and share them with other users, enhancing collaboration and oversight in complex insurance defense cases.

Navigating Ethical Dilemmas in Insurance Defense

When conflicts between the insurer and insured become unmanageable, the insured may be entitled to independent counsel, known as Cumis counsel. This arises when the insurer’s position creates a conflict, preventing insurer-appointed counsel from fully representing the insured’s interests, as established in San Diego Federal Credit Union v. Cumis Insurance Society, Inc. [162 Cal.App.3d 358 (1984)]. While many states have adopted similar principles, specific rules differ across jurisdictions.

Additionally, insurer-imposed billing guidelines can challenge attorneys by potentially conflicting with their professional judgment. If these guidelines interfere with competent representation, they raise ethical concerns that vary by state.

Defense attorneys must maintain independence in legal strategy, settlement recommendations, and scope of work based on professional judgment, not insurer directives. Advanced legal practice management platforms can help navigate billing-related dilemmas by allowing attorneys to review and filter unbilled activities before finalizing invoices, ensuring compliance with ethical standards while managing insurer guidelines efficiently.

Balancing Confidentiality and Communication

Projecting Client Confidences

Confidentiality is central to the attorney-client relationship, and in the tripartite relationship, defense counsel must carefully balance sharing information with the insurer while safeguarding the insured’s confidence—especially when sensitive information might affect coverage.

Conflicts can arise when the insured shares information with counsel but asks not to disclose it to the insurer. In states like Texas, where the insured is the sole client, counsel must provide relevant case details to the insurer, yet cannot disclose without the insured’s consent. This requires open communication with the insured about why certain information should be shared.

Managing Co-Defendant Conflicts

Managing co-defendant conflicts insured by the same company adds complexity. Early identification of these conflicts may require recommending separate representation. LPMS solutions with strong document management features, like CARET Legal, allow control over document access and confidentiality, ensuring sensitive data is only accessible to authorized personnel.

An important step is reviewing reservation of rights letters, which may include critical coverage limitations. These letters must be carefully analyzed to avoid coverage-related conflicts.

Strategy Decisions and Settlement Discussions

Conflicts can arise when the insurer and insured disagree on the case strategy. For instance, the insurer might request that defense counsel file claims against the insured’s subcontractor for contribution, while the insured may resist due to ongoing business relationships. In jurisdictions where the insured is the only client, defense counsel cannot take sides in such disagreements and should advise the insured to discuss the issue directly with the insurer.

Regarding settlement, it’s crucial to align strategies among all parties from the outset. Some policies contain consent clauses requiring the insured’s consent to commence settlement discussions. Claims professionals should always be looking for resolution opportunities and should discuss the benefits and drawbacks of settlement versus continued litigation with the insured.

Task management features in LPMS can help manage strategy decisions and settlement discussions. You can typically associate tasks with designated matters, assign tasks to team members, and set up alerts for when tasks are overdue or completed. This can help ensure that all necessary steps in the strategy or settlement process are followed and documented.

Using advanced legal practice management software, insurance defense firms can more effectively identify and address potential conflicts, preventing serious issues before they arise

Developing a Robust Conflict Check System

To effectively manage conflicts of interest in insurance defense, firms should establish clear systems and protocols. A well-organized conflict check process is crucial to avoid ethical concerns before they escalate into serious issues.

- Comprehensive Contact Database: Regularly update and maintain a searchable database that tracks clients, opposing parties, and witnesses. This proactive system allows firms to swiftly identify potential conflicts before taking on new cases or when new parties are added.

- Training for Attorneys and Staff: Conduct regular training sessions focused on both the legal and ethical aspects of conflict management. Providing practical strategies for recognizing and addressing potential conflicts helps create a culture of vigilance, where issues are identified before they become significant.

- Clear Communication Protocols: Implement consistent communication guidelines with claims adjusters and other stakeholders. Clear, regular communication prevents misunderstandings and conflicting interpretations, reducing the chances of disputes arising as cases progress.

- Modern LPMS Solutions: Leverage advanced legal practice management systems to streamline conflict management. These tools allow for custom fields, codes, and filters, making contact organization more effective. CARET Legal’s enhanced features, such as its contact management system, allow you to assign customized color codes to each Matter Role, making it visually easier to identify potential conflicts at a glance.

By combining these strategies, firms can safeguard their practice, build client trust, and maintain compliance with ethical standards while managing the complex relationships in insurance defense.

Leveraging Technology for Conflict Management

Legal practice management software offers a suite of tools that can be particularly useful for managing potential conflicts of interest in complex legal environments like insurance defense:

Contact Management

Centralize and categorize parties across matters:

Tag and track clients, co-defendants, witnesses, and third-party entities in one unified system. CARET Legal’s contact management lets you assign custom matter roles and surface prior relationships, helping your firm identify conflicts at intake before they become liabilities.

Matter Management

See the full picture of every case, instantly.

Consolidate financials and matter activities into one customizable dashboard. This transparency allows for early detection of overlapping interests, helping your team stay ahead of potential conflicts.

Document Management

Reduce errors and keep files organized.

Streamline the organization, storage, and retrieval of case files, contracts, and correspondence, ensuring that all documents are securely stored and easily accessible. By centralizing information and implementing version control, firms can prevent errors, maintain transparency, and support efficient collaboration across teams.

Task Management

Ensure consistent execution of conflict check protocols.

Assign tasks to team members, keep track of deadlines, and build workflows to reduce manual processes. CARET Legal’s task management keeps your conflict check process accountable and auditable.

Billing and Accounting

Avoid insurer billing disputes and ethical missteps.

CARET Legal supports flexible billing structures, including LEDES formatting and pre-billing. This allows attorneys to review time entries and align billing with both insurer requirements and professional standards.

Secure Client Portal

Maintain confidentiality and streamline communication.

Encrypted client portals allow insureds and insurers to securely access documents and invoices. Especially in complex tripartite relationships, this feature ensures transparency without compromising confidentiality.

Reporting Tools

Monitor and improve your conflict management process.

Generate detailed conflict check reports, track resolution timelines, and identify trends in recurring conflict types. With CARET Legal’s reporting capabilities, you can refine your firm’s protocols and proactively reduce risk over time.

By leveraging these features, insurance defense firms can significantly improve their ability to identify and address potential conflicts, save time on administrative tasks, and focus more on providing high-quality legal representation to their clients.

The Path Forward

Managing conflicts of interest in insurance defense is a continuous challenge that demands vigilance, strong systems, and the right technology. Firms can minimize risks by understanding common conflict scenarios and implementing thorough conflict check processes. Using advanced legal practice management software, insurance defense firms can more effectively identify and address potential conflicts, preventing serious issues before they arise.

Clear communication and defined roles are essential in navigating the tripartite relationship between insurer, insured, and attorney. Technology, such as CARET Legal’s conflict check capabilities, provides a robust solution that automates and connects conflict management with other key practice functions. By embracing these tools, firms can protect their clients, reputation, and ensure ethical practice while improving client service. Take the first step towards more efficient and effective conflict management – schedule a demo of CARET Legal today.