A law firm profit margin is a key indicator of your firm’s financial health and operational efficiency.

Understanding the financial health of your law firm can be a complex task. One critical metric is your law firm’s profit margin. But what is it, and more importantly, what is considered a good profit margin for a law firm? Let’s explore these questions, discuss the average law firm revenue, and explore the specifics of the average small law firm revenue.

Understanding Law Firm Profit Margin

A law firm profit margin is the percentage of total revenue that your law firm retains as profit after accounting for all expenses. It’s a key indicator of your firm’s financial health and operational efficiency. The formula to calculate it is simple:

> Profit Margin = (Total Revenue – Total Expenses) / Total Revenue * 100

For example, if your law firm generates $1,000,000 in revenue and has $700,000 in expenses, your profit margin would be 30%. Understanding this concept and calculating your firm’s profit margin is the first step towards assessing its financial performance. But how can you determine if your profit margin is good?

What Is a Good Profit Margin for a Law Firm?

A good profit margin for a law firm typically falls between 30% and 35%. However, this figure can vary significantly based on factors like the size, location, and practice area of your firm. For instance, a small family law firm in a rural area might have a higher profit margin due to lower overhead costs, while a large corporate law firm in a major city might have a lower profit margin due to higher overhead costs. It’s essential to consider these factors when evaluating your profit margin.

The Risks of Using QuickBooks for Accounting

Quickbooks isn’t always the best choice for law firms. Download our whitepaper The Risks of Using QuickBooks for Accounting for tips on how to approach your firm’s accounting and bookkeeping.

Monitoring Metrics and Running Analysis

Getting a handle on your law firm’s financial health isn’t just about profit margins. It’s about keeping tabs on key metrics. Think utilization rate, realization rate, and collection rate. A low utilization rate? Your attorneys might need to spend more time on billable work. A low realization rate? There could be a hitch in converting billable hours into revenue.

And if the collection rate is on a downward trend, there might be some snags in your billing practices or client payments. By keeping a close eye on these metrics, you can spot where you’re losing revenue and take steps to boost your profit margins.

But tracking these metrics doesn’t have to be a chore. That’s where law firm management software, like CARET Legal comes in. It takes care of tracking these metrics, saving you time and making sure everything’s accurate. Plus, it can run financial analyses, offering valuable insights into your firm’s financial state and highlighting areas that need a bit of work.

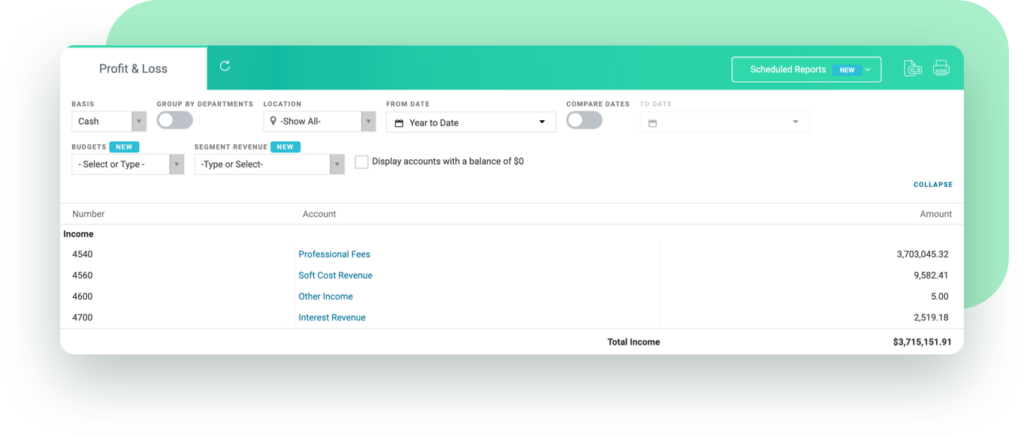

CARET Legal Profit & Loss report

And it’s always good to know where you stand. Comparing your firm’s performance to industry standards like average law firm revenue and average small law firm revenue can help you get a sense of this. If your profit margin is below par, it might be time to rethink your pricing strategy or find ways to cut overhead costs.

But specialized software isn’t just about tracking and analyses. It can automate those routine tasks that eat into your day, freeing up more time for billable work. And it can make it easier for clients to pay you, with options like credit card and online payments. This not only makes life easier for your clients, it could also give your revenue a nice little boost.

Getting a handle on your law firm’s financial health isn’t just about profit margins. It’s about keeping tabs on key metrics. Think utilization rate, realization rate, and collection rate.

In short, by using a digital solution, you can streamline your financial management, get a clearer picture of your financial performance, and give your law firm’s profit margin a lift. It’s a tool that brings all the financial aspects of your law firm together, helping you make smarter decisions for a financially healthier future.

Benchmarking Law Firm Revenue

The average revenue of law firms serves as a helpful benchmark for assessing your firm’s financial performance. Law firms in the U.S., on average, generate substantial revenue each year, but the numbers can vary significantly. For instance, large corporate law firms often report revenues in the millions, with some even reaching upwards of $10 million annually, due to their extensive client base and wide range of services. Recognizing these averages can offer a valuable comparison point to evaluate your firm’s performance and identify potential growth areas.

Small Law Firm Revenue

On the other hand, small law firms, typically those with fewer than 20 lawyers, exhibit a different financial landscape. While their average revenue may be lower, often around $500,000 annually due to fewer resources, they can still maintain a healthy financial state. They manage this by effectively controlling their lower overhead costs, focusing on profitable niches, and building close, long-lasting relationships with clients. For example, a small law firm specializing in a specific area like intellectual property might generate less revenue than a large firm, but by keeping operating costs low, it can still achieve a healthy profit margin. Understanding these dynamics can help small law firm owners strategize effectively for financial success.

Is Your Profit Margin Good?

Understanding your law firm’s profit margin is critical for assessing your firm’s financial health and planning for future growth. As a modern law firm practice owner, you need a clear understanding of these financial metrics to make informed decisions about your firm’s strategy and direction. Investing in a modern practice management solution can provide valuable insights into your firm’s finances, helping you boost your profit margins and drive growth.

So why wait? Sign up for a demo of CARET Legal to take control of your firm’s financial future today!