- ProductCARET Legal Practice Management Features

Leave standalone software behind

Manage all your cases in one place

Simplify repetitive tasks

Gather insights into your firm's performance

Increase billable time and cashflow

Manage your documents

Reach and collaborate with your clients

Grow your client list

More about our product - Who We Serve

- ResourcesLearn

Read all about the latest industry topics

Learn from industry experts

In-depth legal insights

Real perspectives from real people

PartnerSee an extensive list of CARET Legal partners

Join CARET Legal's partnership program today

- Pricing

Estate Planning Case Management Software that Helps You Create and Deliver Plans More Efficiently

Estate planning software enables you to better protect your client’s legacy. With CARET Legal’s practice management platform, you can:

- Save time and increase efficiency

- Easily draft airtight living wills, trusts, and advanced healthcare directives

- Simplify the estate planning process for your clients

Request a free trial

The All-Inclusive Answer for a Firm That Needs Accessibility

When the pandemic hit, Berdon and the rest of the firm realized it was finally time to replace their existing practice management software, an on-premises solution they’d been relying on to run their accounting and more for decades. They decided to make the switch to CARET Legal, a cloud-based legal practice management tool that gave the firm the accessibility and flexibility it needed to operate in remote times.

Estate Planning Software to Protect Client Interests and Minimize Risk

Clients rely on your expertise to protect their wealth, avoid ambiguity, and ensure their wishes are carried out. Managing these details with generic tools wastes time and adds risk. CARET Legal’s estate planning software for attorneys is a purpose-built practice suite that streamlines intake, guides asset transfers, and enhances communication—reducing clerical work and saving valuable time.

Automated Workflows for Estate Planning

Provide best-in-class service to clients with a streamlined approach to managing their estate plans. Automatically create, track, and manage all of your estate planning tasks such as document preparation, client communication, and appointment scheduling.

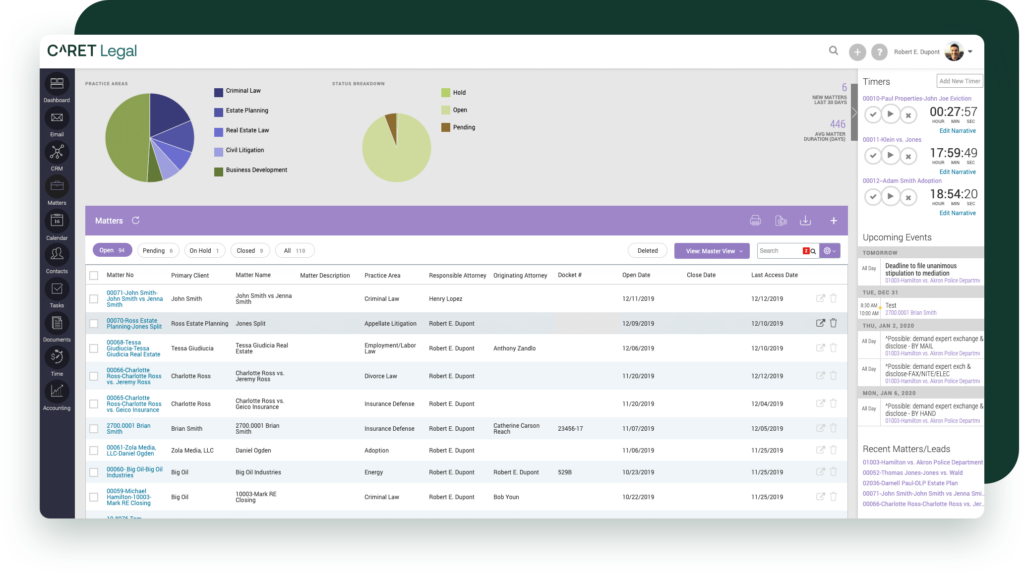

Clarity and Control for Estate Planning Firms — Powered by CARET Analytics

From wills and trusts to probate and asset protection, estate planning requires precision and foresight. CARET Analytics helps you manage your firm with confidence by turning your data into clear, actionable insights.

With intuitive dashboards and meaningful metrics, CARET Analytics helps you focus on what matters most — growing your firm.

- Accelerate cash flow

- Track attorney performance and firm health

- Simplify complex data to support strategic growth

See all that CARET Analytics can do for your firm.

The Best Estate Planning Software Includes These Features

Inside CARET Legal, each of these practice management features can be customized to fit the processes of a typical estate planning firm.

Client Intake & Management

Simplify your client onboarding and case tracking with purpose-built workflows for estate planning. Get real-time results with advanced reporting, streamline client communication, and automate routine tasks —so you can focus more on advising and less on admin.

Legal Calendaring

Estate matters often span years. CARET Legal helps firms stay on top of court dates and signing appointments. Sync calendars across your team, set reminders and alerts, and avoid missed milestones with precision.

Time & Billing for Trusts & Wills

Generate compliant, professional invoices and e-payment options tailored for estate planning services. Automate billing for flat fees or ongoing services, while streamlining trust accounting and reducing write-offs, boosting firm efficiency and cash flow.

Estate Planning Software FAQs

As an estate planning attorney, your work carries weight—it’s about protecting family wealth, ensuring final wishes are honored, and preventing disputes. Estate planning software for attorneys—sometimes referred to as will drafting software or trust software—is designed to support that mission. CARET Legal combines client intake, calendaring, document management, and trust accounting into a single platform tailored for estate law.

CARET Legal replaces scattered tools and manual processes with one integrated system. You can manage estate and trust matters from intake to invoice, automate repetitive tasks, track deadlines, coordinate with clients via a secure portal, and manage documents like wills, trusts, and powers of attorney—all while staying compliant and audit-ready.

Wasting time on redundant data entry, struggling with outdated forms, or chasing signatures shouldn’t slow you down. CARET Legal simplifies your workflow so you can spend more time counseling clients—especially in emotionally sensitive situations—and less time managing paperwork. It’s built to give you peace of mind and help your firm deliver responsive, personalized service.

Yes—CARET Legal is a purpose-built practice suite trusted by estate planning professionals. It includes features like customizable intake forms, document management, trust accounting, and a secure client portal, which makes working with older or less tech-savvy clients easier. Whether you’re drafting wills or tracking complex trust arrangements, CARET Legal gives you the tools to manage it all seamlessly.

Further Reading for Estate Planning Firms

A Guide to Marketing for Estate Planning Attorneys & Getting More Clients

Learn how estate planning attorneys can effectively attract more clients through strategic marketing tactics.

Are You Competent? The Vital Role of Technology in Estate Planning Firms

Understand how technology plays a vital role in enhancing competency for estate planning firms.

Grow Your Estate Planning Practice with CARET Legal Practice Management

Discover important changes happening in real estate law that may signal opportunity for your firm.

CARET Legal Practice Management Features

Leave standalone software behind

Manage all your cases in one place

Simplify repetitive tasks

Gather insights into your firm’s performance

Increase billable time and cashflow

Manage your documents

Reach and collaborate with your clients

Grow your client list

More about our product

Learn

Read all about the latest industry topics

Learn from industry experts

In-depth legal insights

Real perspectives from real people

Partner

See an extensive list of CARET Legal partners

Join CARET Legal’s partnership program today

X

|

CARET Legal is proudly recognized as "Cloud-based Practice Management Platform of the Year" by the 2025 LegalTech Breakthrough Awards. |