Inaccurate invoicing and late payments can have a significant impact on a small law firm’s cash flow and client relationships

For small law firms, managing billing processes efficiently is not just a matter of convenience – it’s a necessity. With limited resources and often minimal experience in complex billing tasks, small firms face unique challenges that larger firms may not. Mistakes in billing can lead to cash flow issues, strained client relationships, and even compliance risks. This blog will explore why legal billing software is a must-have for small law firms, highlighting the benefits, key features, and solutions it offers to overcome common challenges.

The Critical Need for Legal Billing Software

Inaccurate invoicing and late payments can have a significant impact on a small law firm’s cash flow and client relationships. Unlike larger firms, small firms often don’t have the luxury of a dedicated billing department. This makes every billing error more critical, potentially leading to delays in payment that can disrupt the firm’s financial stability.

For instance, if a client is billed incorrectly or receives their invoice late, it can create confusion and dissatisfaction, jeopardizing the relationship. In a small firm, where every client counts, maintaining trust through accurate and timely billing is crucial. Legal billing software mitigates these risks by automating invoicing and ensuring that all billable hours are accurately captured and billed on time.

Benefits of Implementing Legal Billing Software

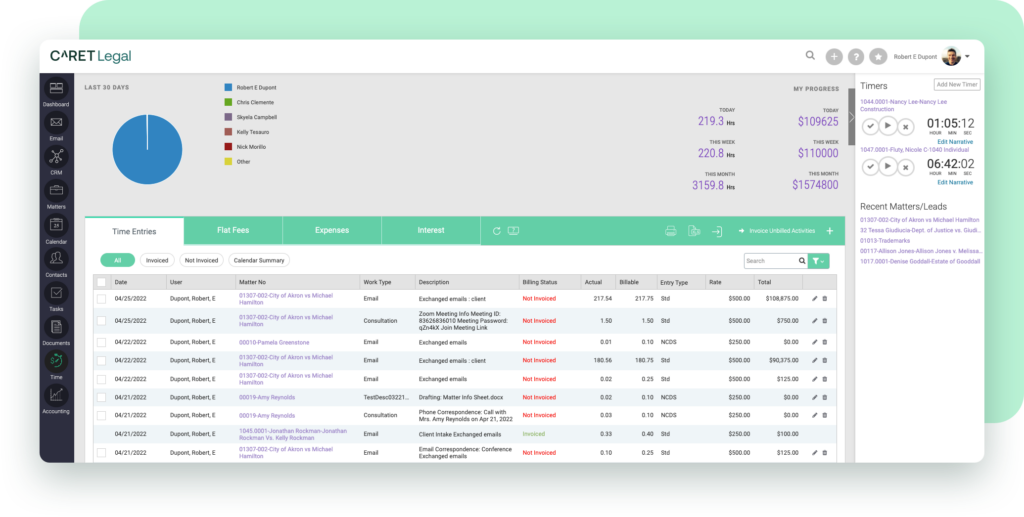

One of the primary advantages of legal billing software is the automation of repetitive tasks. Small law firms often struggle with non-billable work consuming too much of their time. Billing software can automate tasks like time tracking, invoicing, and payment processing, freeing up valuable resources that can be redirected toward billable activities. This not only improves efficiency but also reduces the operational costs associated with manual billing processes.

Clear and transparent billing is key to maintaining strong client relationships. Legal billing software provides detailed and accurate billing statements, helping clients understand exactly what they are paying for. This transparency builds trust and reduces the likelihood of disputes over fees. Additionally, the ability to send invoices promptly and offer detailed explanations of charges enhances communication with clients, leading to higher satisfaction and quicker payment cycles.

Billing software can automate tasks like time tracking, invoicing, and payment processing, freeing up valuable resources that can be redirected toward billable activities

Key Features of Legal Billing Software for Small Firms

Real-time tracking of billable hours is essential for accurate invoicing. Legal billing software allows attorneys to track their time as they work, ensuring that no billable hour is missed. Automated invoicing further reduces the administrative burden, allowing small firms to generate and send invoices with just a few clicks. This efficiency is particularly beneficial for small firms that need to maximize their billable hours without adding extra administrative work.Clients today expect convenience, including flexible payment options. Legal billing software often includes features that allow firms to accept various payment methods, including online payments. This flexibility caters to client preferences and can significantly improve the speed of payments. For small firms, faster payments mean better cash flow, which is vital for maintaining operations and growth.

Overcoming Common Challenges with Legal Billing Software

Small law firms often lack the experience or resources to manage complex billing tasks effectively. Legal billing software simplifies these tasks by providing user-friendly interfaces and automating much of the process. This reduces the need for a dedicated accounting team, making it easier for small firms to handle their billing internally without sacrificing accuracy or efficiency.

Safeguarding client information and adhering to data protection regulations is a non-negotiable when it comes to handling legal matters. Choosing the right legal billing software designed to comply with strict standards is vital. Look for features such as encrypted data storage and secure payment processing to ensure sensitive information is kept private. This not only safeguards client information but also helps small firms avoid the legal ramifications of non-compliance.

Legal Billing Software Is Essential for Small Law Firms

Legal billing software is more than just a tool for managing invoices – it’s a critical component of running a successful small law firm. By automating billing processes, improving client communication, and ensuring compliance, legal billing software helps small firms operate more efficiently and maintain stronger client relationships. For small law firms looking to streamline their operations and reduce the risk of billing errors, investing in robust legal billing software is not just beneficial, it’s essential.

Ready to simplify your billing process and free up resources? Try CARET Legal today and see how our platform can transform your firm.