The Big Takeaways

- Trust accounting must be accurate, transparent, and well-documented to meet ethical standards and protect client confidence.

- Manual fund transfers increase risk, creating gaps in records and complicating reconciliation.

- CARET Legal simplifies trust management with secure, structured workflows.

Trust accounting requires accuracy, transparency, and strong internal controls to maintain ethical legal compliance and protect client confidence. Even small missteps, such as co-mingling funds or mishandling transfers between matters can lead to conversion, disciplinary action, or operational setbacks.

Litigation firms that manage multiple ongoing matters for the same client face added complexity, especially when reallocating retainers or shifting funds to support case progress. By creating clear workflows, maintaining consistent documentation, and using technology that supports compliant and auditable transfers, firms can reduce risk and improve efficiency.

CARET Legal continues to expand tools that help firms uphold ethical trust practices, including upcoming capabilities that simplify matter-to-matter trust transfers.

Trust Accounting Demands Extra Vigilance

Trust accounting protects client funds and ensures they are held and used only for authorized purposes tied to specific matters. Litigation work involves frequent retainers, cost advances, and settlement distributions. Each movement of money carries a requirement for clear documentation, clear permissions, and clear allocations.

Even small administrative errors can lead to steep consequences. Co-mingling funds, misallocating a payment, or breaking the chain of documentation can trigger conversion findings or disciplinary action. State bars expect firms to maintain ledgers that match bank activity exactly. They also expect timely reconciliation that proves the firm monitors trust activity closely.

These expectations apply to every legal practice, yet litigation firms face added complexity because matters often shift quickly. Consistent practices across the entire firm can protect clients and strengthen long-term operational stability.

Common Trust Accounting Issues

Many trust violations stem from preventable operational issues. Manual check requests or spreadsheets introduce errors because they rely on memory and informal steps. Back-office workarounds also become difficult to audit because they generate inconsistent records.

Trust activity must tie to a specific client matter. When documentation does not show which matter a transaction supports, reconciliation becomes slow and error-prone. Missing descriptions, unclear approvals, or incomplete ledgers create the type of gaps auditors watch for.

Limited visibility also causes trouble. If staff cannot see matter-level trust balances, they may initiate transactions without knowing whether funds are available. Monthly reconciliations help prevent this, yet many firms delay them during busy periods. Delays create stale data that hides discrepancies until they become harder to fix.

Disciplinary actions often result from issues such as missing documentation, late reconciliations, or inaccurate allocations. These issues create risk not because they suggest bad intent, but because they break the safeguards designed to protect client funds.

Best Practices for Ethical Trust Management

A clear trust accounting structure gives litigation teams confidence and reduces time spent fixing preventable mistakes.

- Maintain separate ledgers that connect every deposit, withdrawal, and transfer to its corresponding matter. This practice supports accurate reconciliations and creates records that satisfy bar requirements.

- Apply role-based permissions so only authorized employees can initiate or approve trust transactions. Clear permissions reduce the likelihood of incorrect entries and help the firm prove oversight.

- Document every transaction with enough context to create an audit trail. Descriptions should state why the transaction occurred, who approved it, and which matter it affects.

- Use automated reconciliation tools to identify discrepancies early. Automation reduces manual calculations and highlights mismatches before they affect month-end reporting.

- Transfer trust funds between matters only when the system supports transparent workflows. A compliant workflow should show the source matter, the destination matter, and any safeguards that prevent over-transfers or incomplete approvals.

- Provide staff with regular training so they understand how matter-level trust balances work. Matter management insights give firms visibility into case activity and support consistent decision-making across departments.

Multi-Matter Clients: The Hidden Risk

Litigation firms often represent clients who have several matters open at the same time. Insurance defense groups, complex civil litigation teams, and firms handling rolling claims see this pattern regularly. These situations require careful planning because each matter has its own budget, timeline, and trust obligations.

As matters progress, firms may need to reallocate retainers or shift trust funds so teams can complete necessary work. Manual transfers introduce risk because they rely on informal communication and inconsistent documentation. When descriptions lack clarity, the audit trail becomes confusing. When approvals are not captured, the transaction appears unsupported. When ledgers do not update both matters correctly, reconciliation becomes difficult.

Without tools designed for inter-matter fund movement, firms struggle to maintain transparency. Even when the intent is proper, the process itself may not meet compliance requirements. A structured workflow reduces administrative burden and supports ethical practices across all matters.

A Better Way to Handle Matter-to-Matter Trust Transfers

Matter-to-matter trust transfers are sometimes necessary, yet they require controls that most manual workflows cannot provide. Informal methods often omit documentation, fail to update both matter ledgers accurately, or allow transfers that exceed available balances. These issues complicate reconciliation and create compliance gaps.

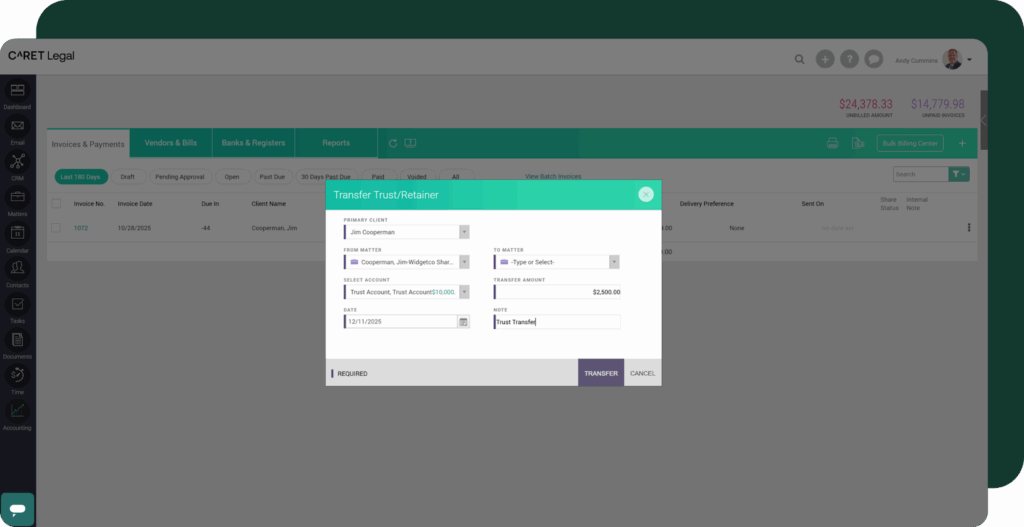

CARET Legal’s Matter-to-Matter Trust Transfers feature provides a guided workflow that minimizes risk. Authorized staff can initiate a transfer within the system, and safeguards help prevent errors such as over-transfers or incomplete approvals. Each step captures context that explains the reason for the movement of funds.

Detailed records appear in both the source and destination ledgers. This visibility creates a clear and auditable path that supports reconciliation and bar compliance. The feature builds on CARET Legal’s broader focus on transparent trust management and structured matter workflows.

Reduce Legal Risk, Not Transparency

Trust accounting supports every aspect of ethical legal practice. When firms manage several matters for the same client, the need for clarity becomes even stronger because funds move more frequently and documentation must stay precise.

Firms can protect clients and reduce administrative strain by adopting technology that supports clean approvals, accurate ledgers, and secure fund movement. CARET Legal continues to introduce tools that simplify trust management and support compliant workflows. These improvements help legal teams focus on strong case outcomes and steady client service while maintaining confidence in their financial processes.

Request your free trial today to see how CARET Legal helps your firm stay compliant, efficient, and client-focused.