To maintain profitability and build trust, firms need a time tracking process that aligns seamlessly with carrier expectations.

Insurance defense firms know how critical precise time tracking is when working with carriers that scrutinize every entry. Audits that uncover missing details, incorrect codes, or misaligned entries can lead to fee reductions or outright rejections of invoices.

To maintain profitability and build trust, firms need a time tracking process that aligns seamlessly with carrier expectations. This blog explores the most common problems related to time tracking and how your firm can create processes that lead to fewer rejected invoices.

Common Audit Issues Related to Time Tracking

Audit rejections often stem from preventable issues that are a result of poor internal processes or habits:

Vague Entries: Entries like “Worked on case” or “Reviewed documents” fail to meet specificity standards – they don’t allow carriers to assess the value or relevance of the work performed.

Block Billing: Combining multiple tasks into a single entry creates transparency issues, making it difficult for carriers to assess individual activities.

Incorrect LEDES Codes: Incorrect or missing codes present a compliance issue which often leads to disputes.

Delayed Entries: Logging time days or weeks after a task was completed might not seem like a big deal, but it often invites skepticism.

Time Tracking Best Practices for Audit-Ready Invoices

Creating audit-ready invoices begins with cultivating detailed, consistent time tracking practices. These foundational habits set the stage for accurate and compliant billing that meets carrier expectations:

- Detail-Oriented Descriptions: Tasks should be broken down into precise, measurable activities (e.g. “Reviewed contract language for compliance with XYZ clause”).

- Granular Time Increments: Log time in small increments, such as 5-minute intervals. This reflects the precise effort that went into each task and dispels any carrier suspicions of block billing.

- Daily Time Logging: Require attorneys to track time daily to make sure entries are accurate and representative of real-time work.

- Consistent LEDES Code Use: Train staff to apply codes consistently and tie each entry to a specific matter or task.

How Legal Practice Management Supports Audit Compliance

Manually adhering to rigorous time tracking standards can be overwhelming for many firms. Fortunately, modern legal practice management systems provide tools to simplify billing compliance.

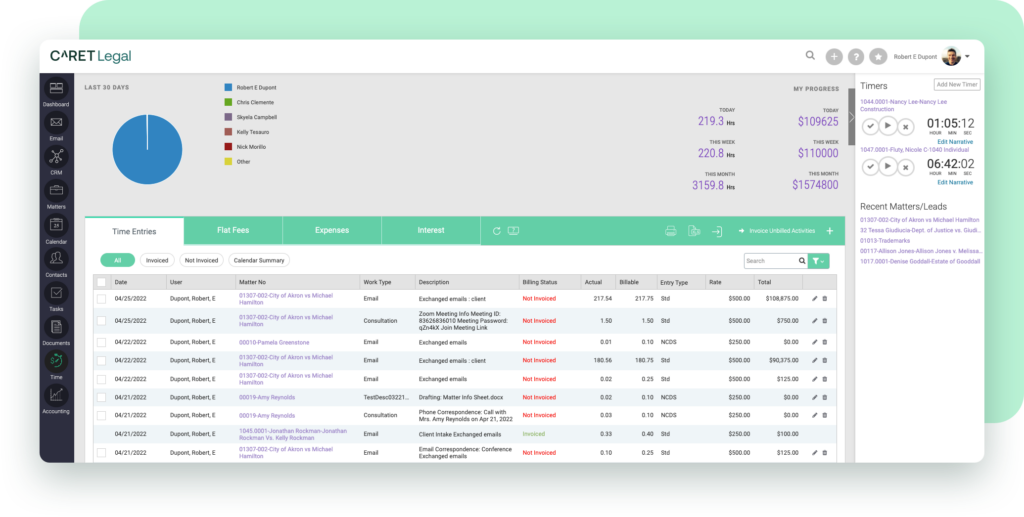

CARET Legal integrates time tracking seamlessly with case management, offering features tailored to insurance defense firms:

- Automated Time Capture: Background tools track emails, document edits, and other activities to reduce missed entries.

- Pre-Built LEDES Code Mapping: Software that automatically applies codes to guarantee consistency, eliminating guesswork.

- Error Detection and Validation: Incomplete or non-compliant entries are flagged before submission, saving time and avoiding disputes.

- Integrated Case Management: Centralizing time tracking alongside case management keeps everything connected and simplifies reporting.

Preparing for Audits with Data-Driven Reporting

Facing audits can be daunting, especially without clear and organized records. Real-time reporting tools can better prepare you for carrier audits by providing transparent, itemized records for every invoice.

Identifying potential problems before they’re picked up by carriers is another great way to ease the audit process. Regularly analyze trends, such as common disputes or frequent coding errors, to identify weak points in billing practices and refine your processes to avoid recurring issues.

Supporting evidence is your firm’s lifeline for justifying invoice expenses and backing up time entries. Link relevant documents or communications directly to time logs for added transparency during audits.

Customizing Time Tracking for Carrier-Specific Guidelines

Every carrier has its own standards – here’s how firms can adapt without adding unnecessary complexity:

- Firm-Wide Standardization: Establish consistent processes that align with even the strictest carrier requirements.

- Templates for High-Volume Carriers: Preload templates tailored to individual carrier needs to reduce inconsistencies and manual input.

- Regular Updates: Make sure your time tracking and billing processes reflect current carrier requirements to avoid disputes.

Insurance Carriers Aren’t Becoming Any More Lenient

To hold your firm’s ground in an increasingly competitive insurance defense market, precise time tracking that meets stringent carrier requirements is a must.

Tools like CARET Legal are tailored specifically to the needs of modern insurance defense firms, helping you stay compliant, reduce errors, and maintain profit. To see how CARET Legal can deliver value for your insurance defense firm, schedule a personalized demo today.