Specialized bankruptcy software is transforming the way attorneys manage these cases, making the process more efficient and accurate.

Navigating bankruptcy cases can be complex and time-consuming for attorneys, especially with shifting regulations and extensive paperwork. Fortunately, specialized bankruptcy software is transforming the way attorneys manage these cases, making the process more efficient and accurate.

What is Bankruptcy Software?

While there are some standalone solutions, most bankruptcy software today is legal practice management software (LPMS) with custom templates, forms, and fields designed to streamline bankruptcy case management and documentation. Your LPMS effectively acts as bankruptcy software for attorneys, providing a comprehensive solution for handling these complex cases within the broader context of legal practice management.

Bankruptcy software supports attorneys in several crucial ways:

- Meeting filing requirements with accuracy and timeliness

- Tracking client information throughout the bankruptcy process

- Automating routine tasks to save time and reduce errors

- Organizing case-specific documents and financial information

By integrating bankruptcy-specific features into an LPMS, attorneys can manage their entire practice while having specialized tools at their fingertips for bankruptcy cases, ensuring efficient handling without sacrificing attention to other practice areas.

Key Features of Bankruptcy Software for Attorneys

When choosing bankruptcy software, attorneys should look for features that address the unique challenges of bankruptcy practice. These key features can significantly improve the efficiency and accuracy of managing complex bankruptcy cases:

- Intelligent Document Automation: Bankruptcy cases involve extensive paperwork with a high risk of errors. Advanced document automation uses smart templates to auto-generate forms, pulling relevant data to populate documents accurately. This not only saves countless hours but also minimizes the risk of costly mistakes in critical filings, ensuring consistency across all cases.

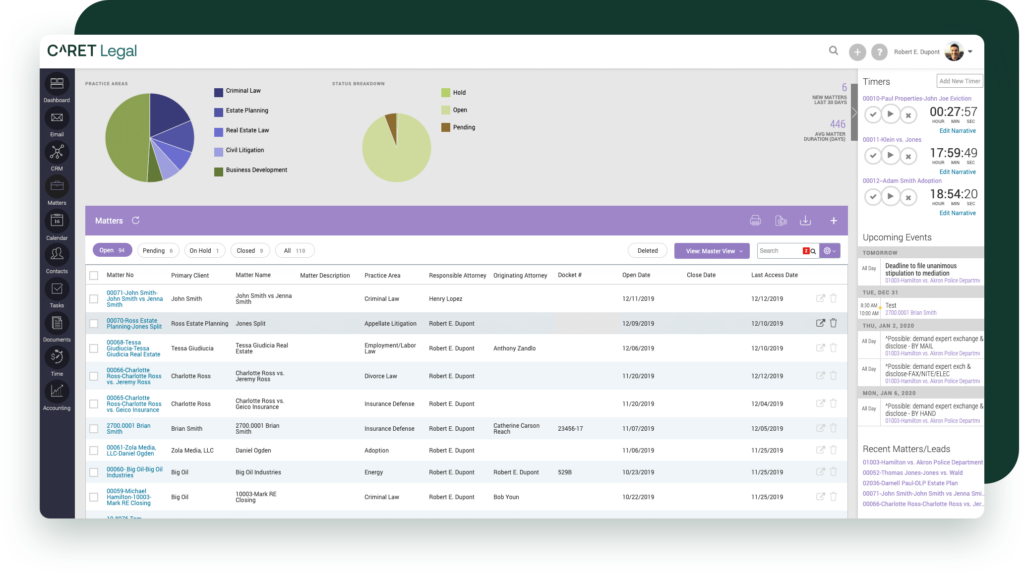

- Comprehensive Case Management: Tracking multiple bankruptcy cases at different stages can be overwhelming. A centralized dashboard that provides an overview of all cases, important dates, tasks, and progress is invaluable. Customizable workflows bring order to the chaos, allowing attorneys to manage numerous cases efficiently and stay on top of every detail.

- Clear Client Communication: Effective communication is essential for providing exceptional client service and achieving successful outcomes. A secure client portal facilitates this by enabling the exchange of documents and invoices, while client texting capabilities make it effortless to maintain ongoing conversations with clients.

- Data Analytics and Reporting: Insight into practice efficiency and case outcomes is vital for improvement. Comprehensive reporting capabilities on case outcomes, financial performance, and team productivity enable data-driven decision-making. These insights help identify areas for growth and optimize practice operations.

- Mobile Accessibility: Bankruptcy attorneys often need access to case information outside the office, especially for court appearances. Secure mobile access to case details, client communication, and task management ensures attorneys are always prepared and responsive, even when away from their desks.

From ensuring document accuracy and meeting deadlines to improving client communication and financial management, the right software addresses the most pressing challenges in bankruptcy practice. This allows attorneys to focus on strategic case management rather than administrative tasks, ultimately leading to better outcomes for both the firm and its clients.

Benefits of Using Bankruptcy Software in Legal Practice

Implementing specialized bankruptcy software in a legal practice offers numerous advantages that can significantly enhance the firm’s efficiency, accuracy, and client service. By automating complex processes and providing robust case management tools, this technology enables attorneys to focus on the strategic aspects of their cases while ensuring compliance and improving overall practice management. Let’s look at why bankruptcy software has become an essential tool for modern law firms:

- Significant Time Savings: Bankruptcy software automates many time-consuming tasks, such as document preparation, deadline tracking, and routine client communications. This automation allows attorneys and staff to focus on more strategic aspects of cases, like developing legal strategies or negotiating with creditors. For example, what once took hours to prepare – like a complete bankruptcy petition – can now be generated in minutes with pre-populated client information.

- Drastically Reduced Errors: The complexity of bankruptcy filings leaves room for costly mistakes. Automated form generation and data entry significantly minimize the risk of errors in critical bankruptcy filings. By ensuring consistency across all documents, bankruptcy software helps maintain the integrity of your submissions and protects your clients’ interests.

- Improved Client Satisfaction and Communication: Bankruptcy software often includes client portals, allowing clients to receive and share case files and pay invoices without direct attorney intervention. This level of accessibility can significantly improve client satisfaction, reduce anxiety, and build trust during what is often a stressful time for clients.

- Increased Efficiency and Caseload Capacity: By streamlining processes and automating routine tasks, bankruptcy software enables firms to handle a larger caseload without sacrificing quality or requiring proportional staff increases. This efficiency can lead to increased profitability and growth opportunities for the firm.

- Improved Case Organization and Management: Centralized case management systems in bankruptcy software provide a clear overview of all active cases, deadlines, and tasks. This organization reduces the risk of missed deadlines or overlooked details, ensuring that each case receives proper attention throughout its lifecycle.

- Data-Driven Insights: Many bankruptcy software solutions offer robust reporting and analytics features. These tools provide valuable insights into your practice’s performance, helping you identify areas for improvement, track success rates, and make informed decisions about your firm’s direction and resource allocation.

- Enhanced Mobility and Flexibility: With cloud-based bankruptcy software, attorneys can access case information, update files, and communicate with clients from anywhere. This flexibility is particularly valuable for court appearances, client meetings, or when working remotely.

- Competitive Advantage: Law firms that leverage advanced bankruptcy software can offer more efficient, accurate, and responsive services to their clients. This technological edge can be a significant differentiator in a competitive legal market, helping to attract and retain clients.

These benefits combine to create a more efficient, accurate, and client-focused bankruptcy practice, allowing attorneys to provide better service while managing their workload more effectively.

By simplifying processes, reducing errors, and improving client communication, attorneys can focus on providing the best possible representation to their clients.

How to Choose the Right Bankruptcy Software

When selecting bankruptcy software, it’s crucial to choose a solution that addresses the unique challenges of bankruptcy practice while offering the flexibility to grow with your firm. CARET Legal stands out as the ideal choice for bankruptcy attorneys for several key reasons:

- Comprehensive Case Management: From initial client intake to final discharge, CARET Legal handles your entire bankruptcy workflow effortlessly. This end-to-end solution eliminates the need for multiple software tools, reducing costs and improving efficiency. You can manage client information, generate documents, track deadlines, and communicate with clients all from one centralized platform.

- Scalability and Customization: Whether you’re handling a few cases a month or managing a high-volume practice, CARET Legal adapts to your needs. As your firm grows, our software scales with you, accommodating more users, cases, and even multiple office locations. Plus, you can customize workflows and templates to match your specific processes, ensuring the software works the way you do.

- Enhanced Client Communication: In bankruptcy cases, clear client communication is crucial. CARET Legal offers a secure client portal where clients can upload documents and pay invoices. Additionally, we offer a client texting feature that allows for quick, two-way communication. These features not only improve client satisfaction but also streamlines internal processes, freeing up time for our staff to focus on providing exceptional legal services.

- Compliance and Risk Management: Staying compliant with bankruptcy regulations is critical. CARET Legal helps reduce risk by:

- Providing audit trails and detailed logs of all case activities.

- Ensuring data security with bank-grade encryption and secure cloud storage.

By choosing CARET Legal, you’re not just getting software; you’re gaining a partner committed to the success of your bankruptcy practice.

Manage Your Bankruptcy Practice with the Right Software

Specialized bankruptcy software has the power to revolutionize how attorneys handle complex bankruptcy cases. By simplifying processes, reducing errors, and improving client communication, it allows attorneys to focus on providing the best possible representation to their clients.

CARET Legal offers a comprehensive solution designed to address the unique challenges of bankruptcy case management. From automated document generation to robust client communication tools, CARET Legal provides the features you need to elevate your bankruptcy practice.

Ready to see how the right software can modernize your approach to handling bankruptcy cases? Schedule a free demo of CARET Legal today and experience firsthand how our comprehensive LPMS can simplify your complex bankruptcy cases, boost your efficiency, and enhance your client service.