It’s important to keep bar association regulations in mind and ultimately choose a platform that will make compliance efforts more efficient.

All law firms are required to maintain accounting records for client funds deposited in trust accounts. Finding the right software solution to assist with the necessary record-keeping for those funds requires a complete understanding of the bar association rules.

Trust Accounting Basics

Client funds are held by lawyers for many reasons. A lawyer may hold client property in connection with representation, settlement funds or legal fees and expenses paid in advance. Bar associations have very specific rules that regulate the safekeeping of client funds, and law firms are required to deposit these funds in a separate bank account to ensure that they are not commingled with operating dollars. Additionally, firms must adhere to very specific record-keeping requirements.

IOLTA Accounts

The bar association safekeeping rules specify that client funds must be deposited in an interest-bearing account. Often, however, the amount of money that a lawyer handles for a single client is quite small or held for only a short period of time and cannot earn interest for the client in excess of the costs incurred to collect that interest. Traditionally, lawyers have placed such deposits into combined, or pooled, trust accounts that contained other nominal or short-term client funds. These accounts are called IOLTA accounts. IOLTA stands for Interest on Lawyers Trust Accounts. The interest earned on these accounts is given back to the bar association.

Trust bank accounts may be used just for one client and the interest earned on those funds will be retained by the client. The safekeeping rules apply to these trust accounts as well.

Most states require that every law firm have an IOLTA account. If a law firm has offices in different states, they may need to open trust bank accounts in each state. The bar association will determine which financial institutions are approved for IOLTA accounts. Banks are not supposed to apply monthly bank fees, however if bank fees are incurred, lawyers’ funds may be deposited to the trust account to pay bank charges.

Record-keeping Requirements

The bar association rules specify that the law firm must maintain detailed records for each client. These records must include all deposits and withdrawals from the trust account broken down by client. Each transaction must include the purpose of the deposit or withdrawal, the date, the client and the source of the funds (or the payee).

The trust account must be reconciled quarterly at a minimum, but it is recommended that the account be reconciled monthly. The bar requires that documentation which verifies the transactions in the trust be maintained for seven years. Examples of the type of documentation that must be maintained, include:

- Client retainer and compensation agreements

- Statements to clients of accountability

- All invoices issued to clients

- Copies of all agreements and closing statements

- Check stubs, checkbooks, bank statements and duplicate deposit slips

Trust Accounting Software Requirements

In selecting the right trust accounting software for your practice, it’s important to keep bar association regulations in mind and ultimately choose a platform that will make compliance efforts more efficient. At a minimum, a good trust accounting system must have the following:

- A check register

- A real-time list of all deposits

- Batch deposit that identifies each client/matter

- Bank reconciliation

- A report of who owns trust money

- A detailed accounting ledger of all transactions, broken down by client

The specific reporting requirements are:

- Trust bank journal – chronological report of all banking transactions

- Trust balances by client matter

- Bank reconciliation report detailing reconciliation to bank and bank journal

- Trust transaction listing by client matter

These reports should be available by bank account, for specific time periods, specific responsible lawyers and specific client matters. A good trust accounting system will also have checks and balances, so you cannot spend money for a client who does not have money in trust.

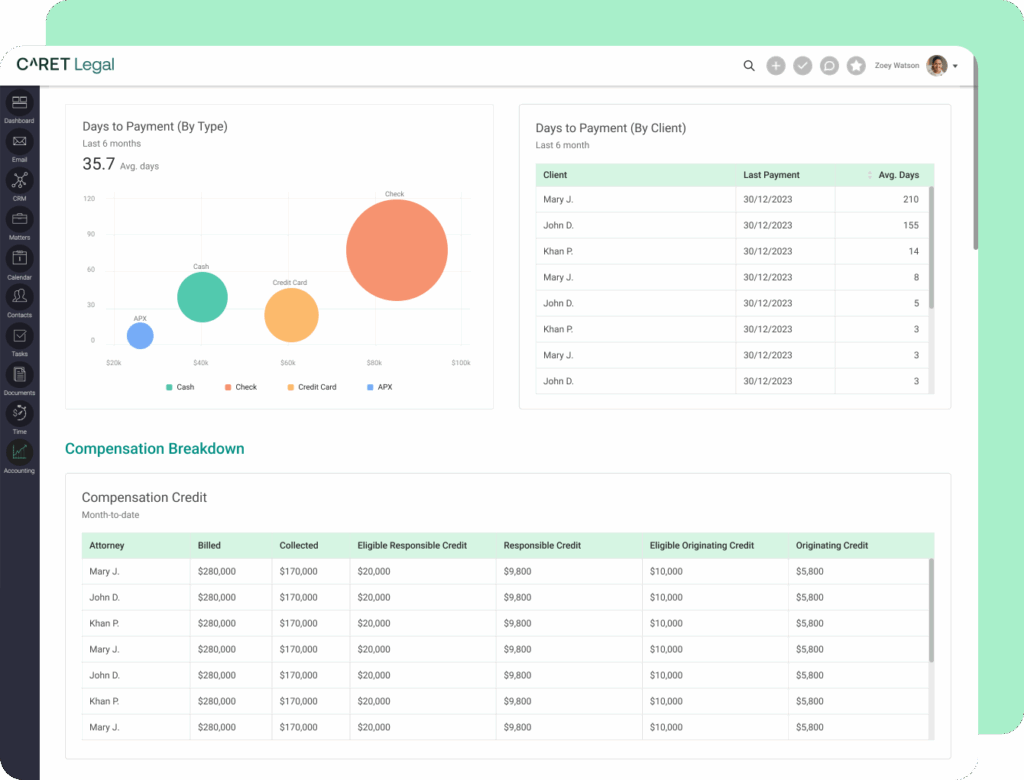

How CARET Legal Simplifies General Ledger Reconciliation

Clean books don’t happen by accident, they require tools that make accuracy easy.

CARET Legal is designed to streamline financial reconciliation at every step, so you spend less time correcting mistakes and more time focusing on your clients. Here’s how.

1. Automated Bank Reconciliation

Connect your firm’s bank accounts and let CARET Legal handle the matching. No more spreadsheets, no more manual matching – just a clean, updated ledger.

2. Built-In Trust Accounting Safeguards

Trust transactions stay clearly separated from operating accounts, and every dollar is accounted for. Reconciliation is simple and audit trails are built right in.

3. Integrated Billing and Expense Tracking

With billing, payments, and expenses all flowing through the same system, your general ledger updates automatically. Fewer manual entries, less room for error.

4. Accurate Financial Oversight

Custom financial reports give you a full picture of your revenue, expenses, and account balances in real-time. It’s easier to stay in control when you have the full picture.

Selecting the Right Solution for Your Practice

There are many different types of software that can satisfy these requirements for lawyers. Some industry-specific software, such as real estate closing applications, include trust accounting tools. There are also dedicated trust accounting solutions that only process trust accounting transactions.

For firms looking for a more comprehensive solution, a practice management platform with complete business and trust accounting should be explored.

As partners and firm admins evaluate and select a trust solution, they should take a holistic approach and consider all the other requirements of the practice. What software is the firm currently using? What processes could be improved? Some key considerations, in addition to legal accounting and legal billing requirements, include: number of users, accessibility (remote access to data), document management, calendaring, management reporting and contact management needs.

Once all the requirements are identified across the practice, systems can be evaluated and selected. Selecting a multi-software solution for most law firms is not an ideal option. This approach can lead to imbalances among the different solutions and create the need to enter the same information in multiple places.

There are many possible solutions for lawyers to choose from. While the number of options may seem overwhelming, understanding your law firm’s specific requirements will make the selection process much easier.

Written by CARET Legal partner, Deborah J. Schaefer. Deborah is a Certified Public Accountant in Connecticut and New York, who specializes in the selection, implementation, training, and support of computer-based accounting systems for law firms. Practicing for over 35 years, she has worked with hundreds of firms across the US and internationally.