Electronic, or LEDES billing is a necessary, and often dreaded, process at many law firms. Between enforcing timekeeping with the appropriate LEDES codes, generating invoices that are in alignment with the client’s requirements and successfully submitting these invoices to various clearinghouses, e-billing can be time-consuming and downright frustrating for the back-office.

LEDES billing is simply submitting your bill in a special format.

What is LEDES billing?

“LEDES” stands for Legal Electronic Data Exchange Standard. It’s an international standard created by an oversight committee to facilitate a uniform mechanism for law firms and corporations to exchange billing information. Within LEDES, UTBMS is the set of standardized codes for time and expenses in areas such as Litigation, Counseling, Project, Intellectual Property, Worker’s Compensation and Bankruptcy. The ability for law firms to provide LEDES invoices can be the difference between winning a new client or losing an existing one.

What the LEDES billing process looks like

LEDES billing is simply submitting your bill in a special format. The electronic bill is uploaded to a service, or clearinghouse, that reviews the bill to make sure it complies with certain rules and that all the calculations are correct. If the bill is approved, you will get paid.

With advanced legal billing tools, firms can reduce friction in the e-billing workflow to get paid faster. These features include LEDES invoices supporting various formats and the option to create custom codes, along with the bulk downloading of LEDES invoices.

But, let’s take a step-by-step look at what the LEDES billing process should look like.

Step 1: Ask your client for submission guidelines

This documentation should include instructions for uploading the bill, specific rules like rates, codes you can use, and details on the format and required fields. Read this documentation carefully and share it with your consultant, if you are working with one.

Step 2: Make sure your practice management platform has LEDES billing software

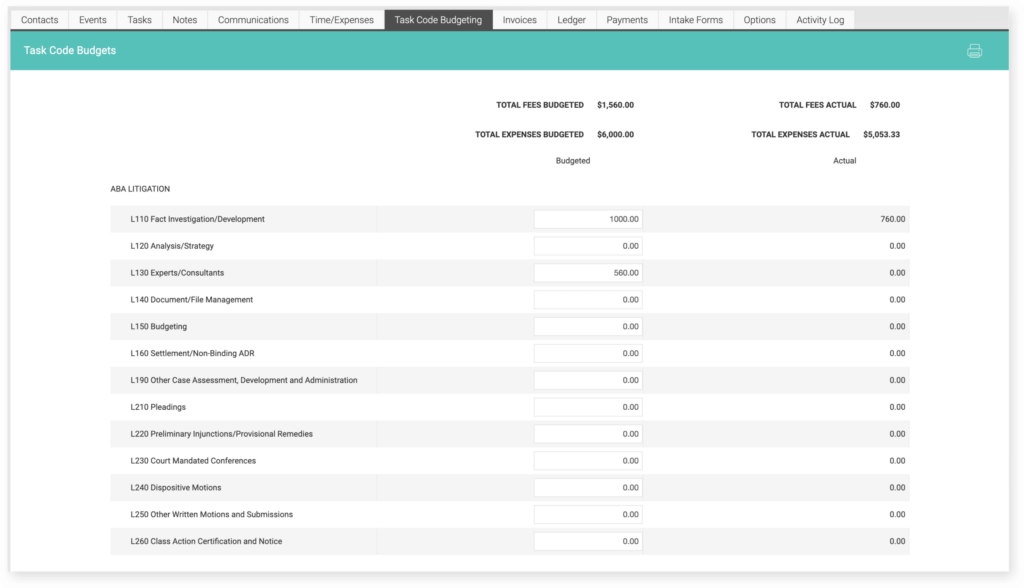

Most billing software for law firms have this capability, although in some cases it is an add-on that you must purchase. In CARET Legal, LEDES billing is included and firms can even set budgets for individual LEDES codes within a LEDES-based matter — giving visibility into billed amounts against the total budget as the case progresses.

Note: If your firm doesn’t do electronic billing, the LEDES format feature won’t be in your way. If only some of your clients or matters require electronic billing, then the time entries and expenses for those matters only will prompt you to select the proper codes designated for that particular matter.

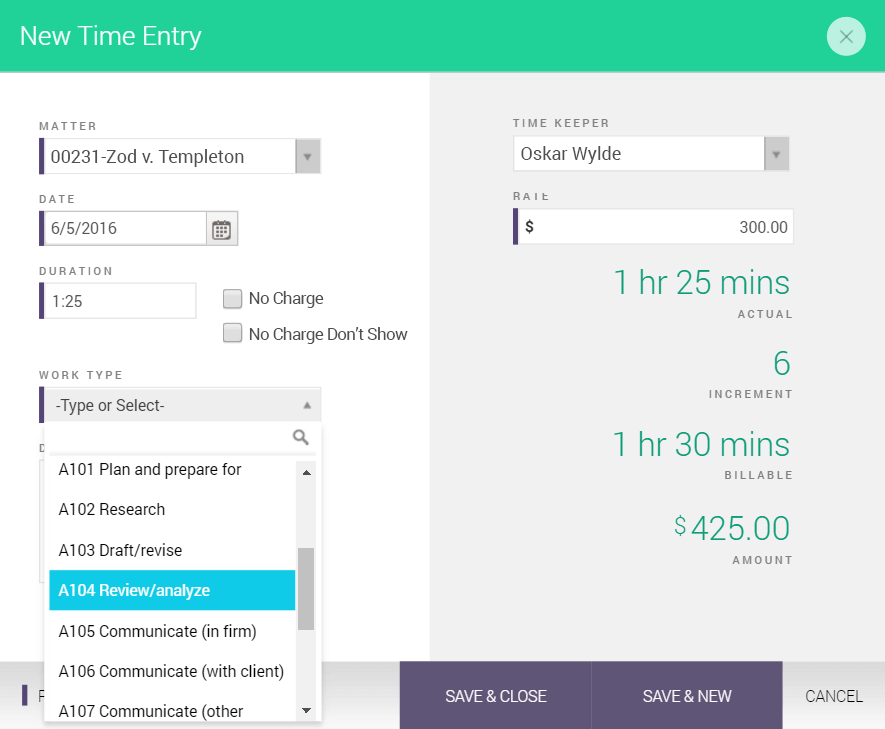

Step 3: Organize UTBMS Codes

Assuming your billing and time tracking software supports LEDES format, you will need to make sure the correct code set is available and can be used with the associated matters. You may hear the term UTBMS —Uniform Task-Based Management Systems — codes. You may need to create these codes or simply turn on the code set for the matter. The UTBMS codes are broken down into categories and phases. Your area of law will determine the code set needed. There are task codes and activity codes, as well as expense codes. Task codes are tied to the area of law. You will probably need an activity code and a task code for each time entry. The codes describe the work being done. You can find a complete list of codes in our Searchable Guides to UTBMS codes.

Pro Tip: In speaking with your legal billing software provider, you should also inquire about hard cost expense management with LEDES billing. A number of platforms enable firms to set UTBMS codes for vendor bills and AP checks which can reduce manual data entry and save your back office a great deal of time during the billing process.

Step 4: Check the custom fields information

Once you have your legal billing codes set up, make sure that any custom field information is defined for the matter. This may include things like the matter ID as defined by the client, dates of the first and last entry on the bill, or the adjuster. There may be other configurations needed in your legal billing software to get the setup correct, so be sure to review the vendor’s documentation and work with your consultant or vendor.

Step 5: Prepare the electronic bill

When you enter time on a matter to be electronically billed, you must include the proper codes. Once the bill is run, you will follow the steps designated by the software vendor to prepare an electronic bill. If you were to open this bill once created, you would see fields of information separated by the vertical bar or “|” character. If you open this file, be careful not to change the format.

Step 6: Upload the electronic bill

Once you have your electronic file, you are ready to upload it to the site provided by your client. You should have been given a login and password, and most clearinghouses will provide some training on the upload process. Upload your file and wait. You will usually get a quick notification as to whether the file was accepted or rejected. Some errors like miscalculations or missing fields will get immediate rejection, usually with a description of the problem. This is NOT unusual the first time you are submitting to a clearinghouse.

Step 7: Make corrections

Make any corrections, recreate the file, and upload it again. Once the file is accepted, you will wait for the “full review.” You should get an email notification telling you whether the bill is accepted or rejected. If accepted, your payment will be issued. If rejected, just find the issue and fix the bill for resubmission.

While this may seem like extra work, the goal of this process is to make sure bills comply with standards and help you get paid faster. Once you get things set up correctly, the ongoing process is usually smooth. Working with your vendor and/or consultant can help you get to “smooth” more quickly.

Written by CARET Legal partner, Caren Schwartz. Caren has been serving the technology needs of the legal industry for almost 30 years and leads the accounting services team at 3545 Consulting – Global. Caren’s key focus is back office services, analytics and best practices for law firms. Caren is the author of QuickBooks for Law Firms.