The key to sustainable profitability is keeping track of crucial law firm financial metrics and insights to assist in decision-making

You can’t improve what you don’t measure. Today, the path toward long-term growth starts with setting clear goals, monitoring key financial and law firm profitability metrics, and tracking your pipeline. By analyzing data to understand which clients, cases, and matters are most profitable, you can make more informed decisions. Using tools with real-time data analytics and comprehensive reporting will provide a clear picture of your practice’s business performance.

Are you fully leveraging data analytics? Check out our post “5 Tips for Improving and Actually Using Your Law Firm’s Data” for some quick tips and tricks.

Law Firm Metrics You Need to Start Measuring Today

Growing profitability demands visibility into several data points. Focusing on these law firm metrics can help optimize operational efficiency, client satisfaction and financial performance.

The key profitability metrics for law firms include realization rate, profit margin, revenue per lawyer (RPL), profit per equity partner (PPEP), billable hours, utilization rate and overhead cost ratio.

The key profitability metrics for law firms include realization rate, profit margin, revenue per lawyer (RPL), profit per equity partner (PPEP), billable hours, utilization rate and overhead cost ratio.

Conducting a profitability analysis? Read our post: “Conducting a Law Firm Profitability Analysis with Practice Management Software” to ensure you’re on the right track.

Realization Rate

The realization rate measures the ratio of billable hours that are billed and collected from clients. A high realization rate implies effective billing practices, while a low rate may suggest issues with fee collection or discounting, although when it comes to determining partner compensation and incentivizing performance, the profitability of the case is a much more effective metric. In certain situations, profitability may prove to be a superior incentive compared to realization (also known as origination credits) and realization rate.

Profit Margin

The profit margin of a firm is determined by dividing its net income by its revenue, resulting in a percentage that reflects the overall profitability of the firm. A larger profit margin signifies greater profitability. Profitability metrics can offer insights into the degree of efficiency in firm processes such as timekeeping, billing and collection processes and higher client retention rates.

While partners may consider profitability in terms of the overall profitability of the firm, it can also be calculated on a per-matter basis. To compare profitability across different matters, it is necessary to express profitability as the profits per notional equity partner who worked on the specific matter. Matter-level profitability can help identify which areas of practice or which matter types bring in the most revenue and can aid in making decisions about the types of clients or matters to pursue.

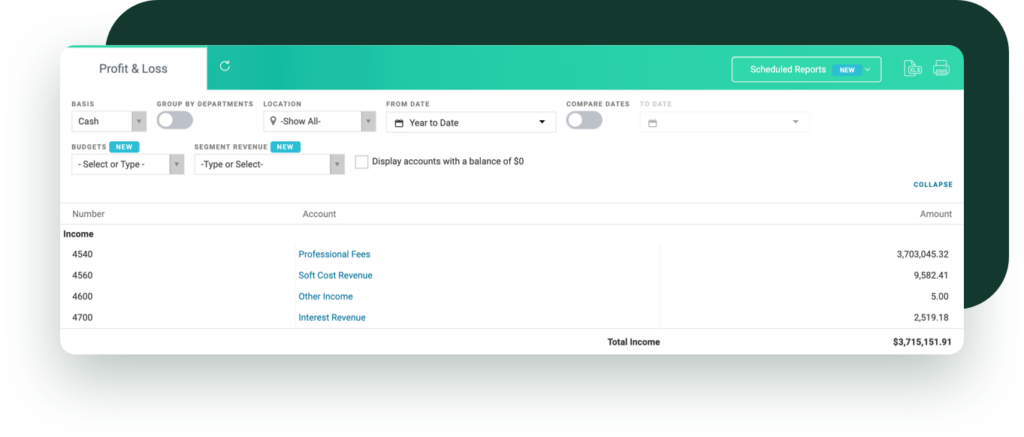

Profit and Loss report in CARET Legal

Setting KPIs around the unique strengths of your business will position you optimally to gauge success, strategize for growth and provide your clients with the level of service they deserve.

Revenue per Lawyer

Revenue per Lawyer (RPL) is determined by dividing the overall revenue of a firm by the number of lawyers employed. This measurement reflects the average revenue generated by each individual lawyer, enabling comparisons across firms of varying sizes.

Profit per Equity Partner

Profit per Equity Partner (PPEP) rates are calculated by dividing the firm’s net income by the number of equity partners. This metric shows how much profit is generated by each partner and is often used to compare the financial success of partners at different firms.

Billable Hours

Billing rate growth is the metric that measures the annual percentage increase in a firm’s average billing rates. A higher billing rate growth can signify strong demand for the firm’s services and an ability to increase prices.

It appears our current economic cloud has a silver lining. A 2022 report by LexisNexis CounselLink shows that partner billing rates surged to record levels last year “in all tiers of law firms and in all practice areas,” but it was high-dollar practices that commanded some of the largest rate increases, with mergers and acquisitions, commercial contracts and corporate practices leading the way. Hourly rates for all partners jumped between 2021 and 2022 by 4.5%. That’s higher than the increases in 2020 (3.5%) and 2021 (3.4%), and the highest since CounselLink first began producing the trends report in 2013.

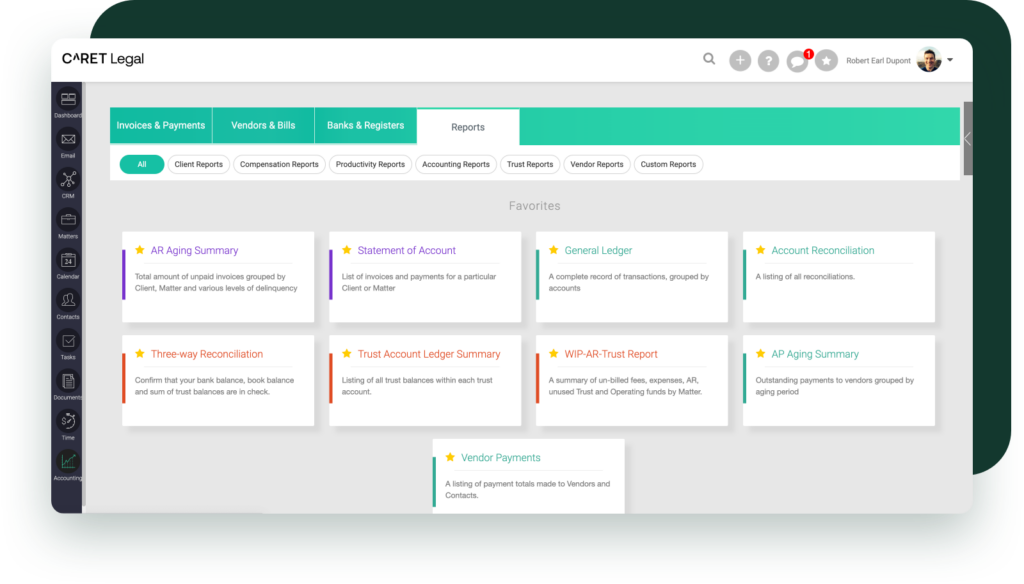

CARET Legal has over 30 reports, including client, compensation, productivity, accounting, trust, vendor and custom reports.

Utilization Rate

The utilization rate is the percentage of billable hours worked by lawyers compared to their available working hours. A high utilization rate indicates efficient resource allocation and can contribute to overall firm profitability.

Overhead Cost Ratio

Overhead per lawyer is calculated by dividing the firm’s overhead expenses by the number of lawyers. This metric helps firms understand their overall cost structure and identify areas for cost reduction.

Reports that will aid you during tax season

Our webinar showcases the various accounting reports you’ll need during tax season, including 1099s, Profit & Loss Statements, and Write-Off reporting.

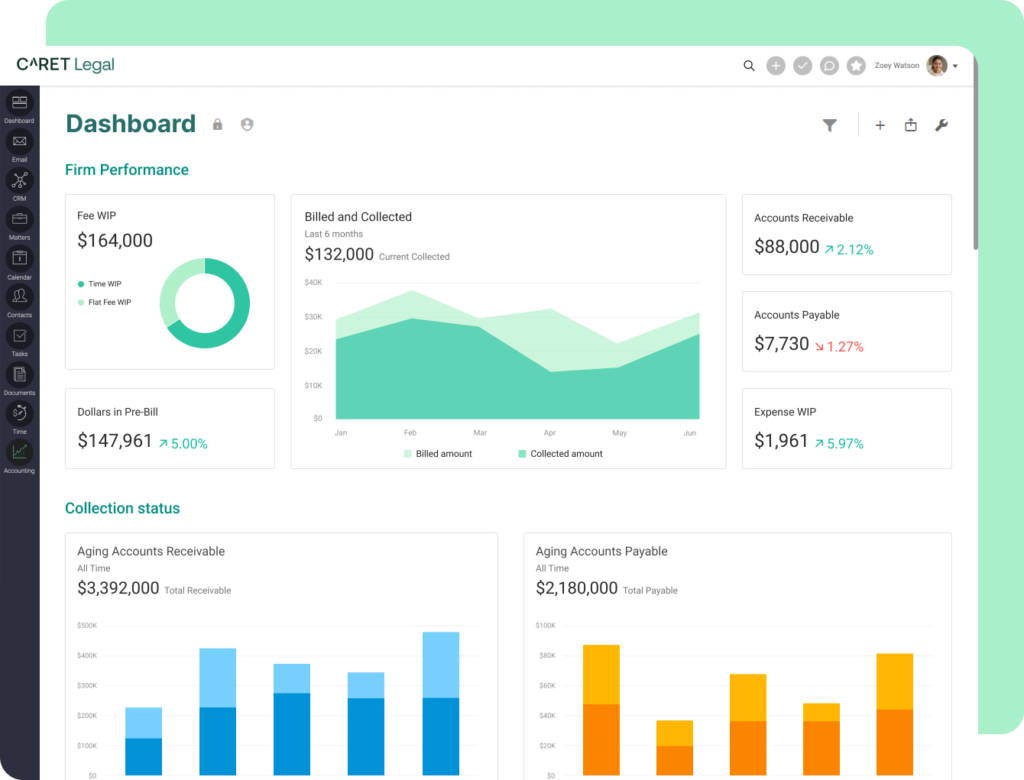

The Power of a Law Firm Profitability Dashboard

Tracking your KPIs using a dashboard will make your data analysis efforts much more efficient and productive. The advantage of a KPI dashboard is that it enables you to adapt and adjust your tracking strategy to meet evolving demands, making your operations more agile. When assessing a legal practice management system, it is essential to seek out tools that can effectively report on law firm performance metrics that are important to your business. A visually appealing dashboard serves as an excellent means to monitor and display real-time progress toward your goals.

Snapshot of out-of-the-box analytics in CARET Legal

Key elements to include in your dashboard:

To effectively monitor your law firm metrics and track progress toward your objectives, it is recommended to incorporate a diverse range of dashboard KPIs and graphs. The most effective dashboards, like CARET’s, are tailored to specific roles and can feature the following:

- Daily agenda with reminders, calls and meetings

- Accounting overview displaying work in progress, payments, accounts receivable and AR aging to draw attention to areas requiring attention

- Income and expense tracking for the current year or any desired period

Learn how to create an actionable dashboard in our post “Build a Better Law Firm KPI Dashboard for Reporting“.

Advanced Profitability Reporting

At CARET, we’ve got a robust library of pre-built client, compensation, productivity, accounting, trust, and vendor reports to help you position yourself for growth. Additionally, we now offer advanced reporting capabilities with CARET Analytics, delivering real-time insights through intuitive, configurable dashboards.

With CARET Analytics you can:

- Identify revenue opportunities

- Accelerate cashflow

- Improve resource allocation

- And more

You can learn more about CARET Analytics in the video below.

Visualize your firm’s data to make better, more informed decisions. Explore the out-of-the-box and advanced law firm performance reports inside our case management software. Get a free trial of CARET Legal today.