Without organized systems and reliable reporting, firms struggle to maintain trust account compliance, track profitability, or plan for sustainable growth.

Accurate financial records are the backbone of a healthy law practice. Without organized systems and reliable reporting, firms struggle to maintain trust account compliance, track profitability, or plan for sustainable growth. Law firm accounting requires calls for processes designed around legal billing rules, client trust funds, and practice-specific financial workflows.

CARET Legal supports firms with tools tailored to legal accounting and law firm bookkeeping software. With the right approach and the right systems in place, law firms can avoid costly errors, maintain compliance, and gain the insight they need to operate with confidence.

How Legal Accounting Differs from Standard Bookkeeping

Legal accounting combines traditional business finance practices with the added complexity of client money management and jurisdiction-specific rules. Mistakes in these areas can have significant consequences, including regulatory penalties, damaged client trust, and internal disorganization.

There are two major components of law firm accounting:

- General Accounting: Tracks income, expenses, payroll, operating costs, and taxes. Like any business, law firms must manage their financial health by keeping accurate records of every transaction that affects the firm’s bottom line.

- Trust Accounting: Tracks funds held on behalf of clients. These accounts must be maintained separately and managed according to state bar regulations. Mismanagement of trust funds is a common cause of audits and disciplinary action.

Unlike other industries, law firms often receive advance payment for services through retainers. That money cannot be recorded as revenue until earned. This makes a clear separation between operating and trust accounts necessary. Legal accounting software supports this separation and helps avoid violations by automating many of the manual processes that often introduce risk.

By choosing law firm accounting software that understands the specific requirements of legal billing and client fund management, firms can reduce errors and avoid common pitfalls.

What Successful Law Firms Do Differently with Accounting

Legal bookkeeping and accounting can be complex, but consistent practices help reduce risk and improve long-term stability. These best practices support smoother operations and better financial clarity:

- Keep operating and trust accounts fully separated: Never co-mingle funds. Use legal accounting tools that clearly distinguish and track these accounts.

- Use dedicated legal accounting software: General business platforms often lack the safeguards needed for trust fund compliance or legal billing rules. Law firm accounting software includes these safeguards by design.

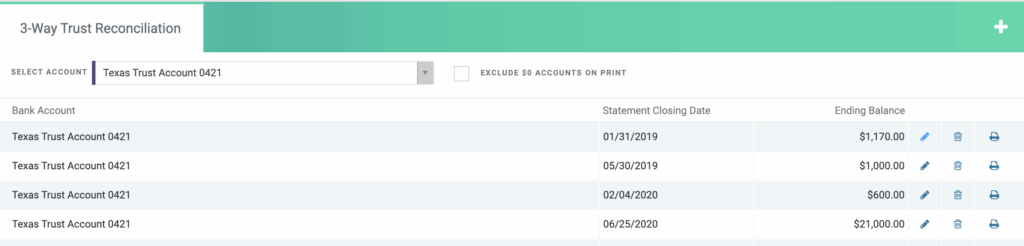

- Reconcile trust accounts monthly: Regular reconciliation helps detect errors, prevent overdrafts, and prepare for audits.

- Record income only when earned: Avoid early recognition of revenue from retainers or prepaid services. Follow the cash-to-accrual timeline that matches legal billing cycles.

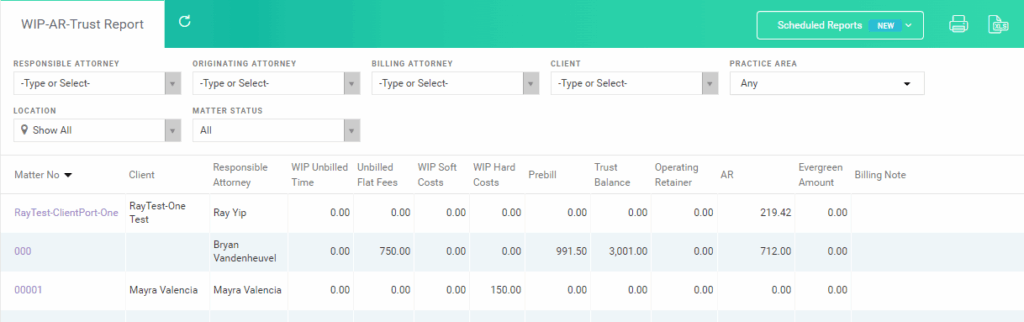

- Track expenses by matter: Associating costs with individual matters allows for more accurate client billing and better reporting on profitability.

- Document every transaction clearly: Keep detailed records of who paid, for what service, and how funds were applied. This supports both client transparency and internal oversight.

- Automate where possible: Law firm bookkeeping software like CARET Legal offers built-in tools for invoice generation, trust ledger management, and expense tracking, reducing the need for manual entry.

- Secure financial data with: A secure system should track all actions, including edits and adjustments, to maintain transparency and accountability.

- Generate financial reports regularly: Don’t wait until year-end to understand your firm’s financial health. Monthly reporting supports better decisions and early identification of issues.

Following these practices with support from purpose-built legal accounting tools can save time, reduce risk, and provide greater confidence in every financial decision.

Why General Accounting Software Can Fall Short

Not all accounting software is designed to handle the demands of law practice. Traditional systems often lack tools for managing trust accounts, assigning expenses to matters, or generating compliant billing reports. This creates more work for internal staff and increases the chance of human error.

CARET Legal provides integrated law firm accounting software that aligns financial data with your legal workflows. Invoicing, payments, trust fund activity, and expense tracking are all connected to the appropriate matter. This reduces duplicate data entry and ensures records are complete.

With interactive dashboards, firms can view account balances, outstanding invoices, and work-in-progress all in one place. The platform also supports compliance by automatically maintaining audit-ready trust ledgers and secure transaction histories.

Connecting Financial Clarity with Firm Growth

Accurate, organized financial records are necessary for staying compliant and providing the insight law firms need to plan ahead. With access to detailed reporting, law firm leaders can analyze billing patterns, identify underperforming areas, and allocate resources where they’re most effective.

Legal bookkeeping should support, not hinder, the ability to scale. As firms grow, so does the complexity of managing financial data. That complexity becomes manageable with law firm bookkeeping software designed specifically for legal practice. CARET Legal scales with your firm, allowing you to maintain financial clarity no matter how your team or caseload evolves.

Instead of managing spreadsheets or disconnected tools, your team can work within a unified legal platform that ties together accounting, casework, and client collaboration. This connection reduces friction, increases accuracy, and keeps financial operations aligned with legal work.

Start a free trial of CARET Legal and see how legal accounting software built for law firms can support smarter bookkeeping, greater transparency, and lasting stability.