The Big Takeaways

- Standalone financial tools create operational blind spots, increase compliance risk, and slow down billing with manual, disconnected workflows.

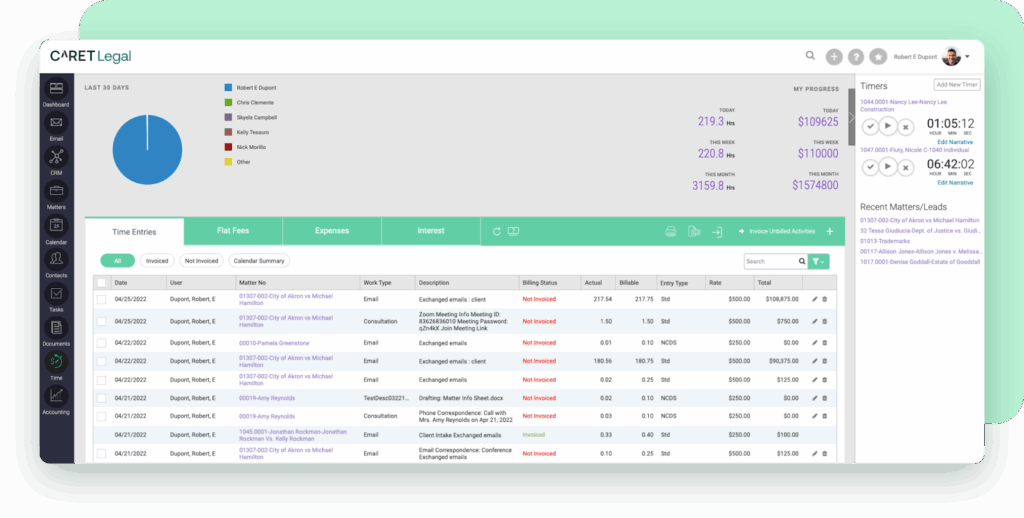

- Integrated practice management platforms improve accuracy, streamline financial tasks, and strengthen audit trails by connecting billing, time tracking, and trust accounting to each matter.

- CARET Legal unifies financial and operational data in one secure system—reducing risk, enhancing collaboration, and scaling seamlessly with firm growth.

The ABA’s 2023 Cybersecurity TechReport found that 29% of surveyed firms experienced a security breach, and 19% were unsure if they had. That uncertainty reflects the challenges of fragmented systems, where data lives in multiple places without clear oversight.

Integrated legal practice management platforms give firms a complete view of both financial and matter data, improving efficiency, clarity, and risk protection as the firm grows.

Why Firms Look for Alternatives to Standalone Financial Management Tools

Many law firms still rely on standalone financial tools to handle billing, payments, trust accounting, reporting, and reconciliation. These tools often look convenient at first, but the separation between financial activity and matter activity creates blind spots that slow daily operations and increase compliance risk.

Fragmented Systems Slow Down Firm Operations

Switching between billing software, document storage tools, time trackers, and case management systems forces staff to hunt for information instead of acting on it. Productivity drops because every workflow becomes a series of manual handoffs.

Manual data entry adds another layer of risk, since entries copied between systems often contain errors that flow directly into invoices, budgets, and month-end reporting. Even small discrepancies require extra staff time to review, correct, and reconcile.

Reporting also suffers in siloed environments because financial data lacks the matter context needed to reveal utilization patterns, workload distribution, and the relationship between effort and revenue.

Compliance Risks Increase When Financial Data Is Disconnected From Matters

Without a matter-linked view of every deposit, disbursement, and transfer, maintaining accurate audit trails becomes difficult. Integrated trust accounting adds the context that standalone systems miss because every financial event ties directly to a matter, helping prevent commingling and misapplication of funds. Structured reconciliation workflows and matter-linked accounting help teams identify issues early in the reporting process.

What Standalone Software Typically Can’t Do

Financial data rarely includes the matter details that give it meaning. Without a direct connection to casework, attorneys lose visibility into how time, documents, deadlines, and communication relate to billing, profitability, and workload.

An integrated matter-centric environment fills this gap by keeping operational and financial data in the same place.

Reduce Accuracy in Time Tracking and Billing

Time entries often move between systems through exports, imports, or manual retyping. Each extra step increases the risk of lost entries or incorrect amounts. Revenue leakage accumulates quietly because the errors are small but persistent. Some standalone tools also lack LEDES or UTBMS safeguards, which forces teams to manually verify codes and formatting, slowing billing cycles and increasing the likelihood of disputes.

Offer Reporting With Operational Context

Reports generated solely from financial tools rarely include workload metrics, deadlines, staff productivity, or document activity. Without operational context, firm leaders can’t evaluate the drivers behind revenue or spot early indicators of bottlenecks.

Why Integrated Practice Management Platforms Offer a Stronger Alternative

An integrated platform serves as a single source of truth for matters, documents, communication, billing, payments, and trust accounting. Teams work from the same up-to-date information, eliminating double entry and reducing the administrative overhead required to keep systems aligned.

This unified environment also improves visibility across the firm.

Partners can evaluate profitability, utilization, collections, and cash flow with greater accuracy because the data reflects both financial activity and the operational work driving it. Trends become clearer and decision-making improves as a result.

Built-In Compliance and Risk Controls

Matter-linked trust accounting reduces the chance of misapplied funds by making sure every transaction includes the correct context. Balances and ledgers update automatically as activity occurs, which keeps reconciliations consistent and transparent. Integrated platforms also create audit trails that document updates made from your team, giving firms reliable records during audits and client reviews.

Consolidation strengthens cybersecurity by reducing the number of exposed access points, limiting overlooked vulnerabilities.

Streamlined Billing, Payments, and Collections

When time tracking, matter management, billing, and payments operate within the same system, the financial workflow becomes more efficient. Time entries and expenses flow directly into draft invoices, reducing errors and accelerating billing cycles. Integrated payment tools record transactions inside the matter record automatically, improving accuracy during reconciliation and month-end reporting.

These connected processes remove many of the manual tasks that typically fall on administrators, allowing staff to focus on resolving exceptions and higher-value work rather than moving data between disconnected tools.

Automated Workflows That Connect Legal and Financial Tasks

Automated workflows help firms maintain consistency from the moment a matter is created. Tasks and deadlines can populate automatically, reducing oversights and giving each case a predictable structure. Shared calendars, alerts, and approvals keep teams aligned, which minimizes bottlenecks and miscommunication as matters progress.

Because attorneys, paralegals, and billing staff all operate within the same system, collaboration improves and clients benefit from more reliable communication and follow-through.

Document, Email, and Communication Tools That Improve Financial Accuracy

Centralized document storage keeps engagement letters, retainers, billing guidelines, and agreements inside the matter workspace, making it easier for teams to follow client requirements and avoid errors. Emails and messages become part of the matter record as well, creating a clear link between communication, work performed, and financial activity. Integrated sharing tools reduce dependence on unsecured channels, ensuring that sensitive files reach the right recipients and supporting stronger compliance and client trust.

When a Standalone Tool Isn’t Enough

As caseloads increase or more staff join, standalone tools show strain. Gaps arise around automation, trust accounting, matter visibility, calendaring, collaboration, and security across multiple systems. These issues compound over time, making standalone setups harder to sustain as the firm expands.

Why Integrated Platforms Like CARET Legal Are the Strongest Alternative

An integrated platform supports the full lifecycle of a matter, including case and matter management, billing, payments, trust accounting, time tracking, document management, calendaring, secure client communication, and automated workflows.

This creates a cohesive operational foundation instead of relying on a patchwork of separate apps that can:

- Eliminates tool sprawl and reduces subscription costs. A single login and unified ecosystem replace multiple disconnected tools. Fewer systems lower costs, reduce administrative overhead, and simplify daily workflows.

- Scales with the firm. Whether a firm expands its practice areas, adds new roles, or increases caseload volume, an integrated platform adapts without the strain of syncing, replacing, or reconfiguring external systems.

Move Beyond Standalone Financial Software

Integrated practice management platforms help firms improve financial accuracy, strengthen cybersecurity, enhance compliance, reduce administrative work, increase collaboration, and gain clearer visibility into operations.

Explore the full capabilities of CARET Legal’s all-in-one legal practice management software to unify your financial and operational data in one secure platform.