Most bar associations require a three-way reconciliation of the IOLTA account.

Whether your state calls it an “IOLTA account” or an “ILTA account,” attorneys are responsible for any trust/escrow/IOLTA funds. Most bar associations require a three-way reconciliation of the IOLTA account. Depending on the legal practice management software you use for managing your firm’s trust funds, this could be as simple as pressing a button and reviewing the report; however, even if your process is that simple, it is important that you understand the “magic” behind the report.

What is three-way trust reconciliation?

A three-way reconciliation is simply making sure that the following three numbers match:

- Bank account balance

- Book balance

- Balance by matter

Simple, right? Let’s look at what each of these means.

Bank Account Balance

Bank account balance is the amount shown in the bank. The three-way reconciliation is usually tied to your bank statement’s closing date. It is important to always reconcile your bank statement in a timely manner. If there are errors, they should be reported to the bank and addressed immediately. Failure to report an error in a timely manner can remove the obligation of the bank to fix it. Quickly checking everything can also help to stop fraud. It is always a good idea for a senior partner to be the one to open the bank statement and do a first review.

Ideally, the bank returns the cleared checks, or copies of the checks, so they can be examined. If there are old, uncleared transactions, they should be handled in the manner designated by your bar association. This usually means finding the party that is owed the money or returning the funds to the client. If that can’t be done, you must turn the funds over to the state. States have rules about how long you can wait on these older transactions so make sure you know your state’s guidelines.

Risks of Using QuickBooks for Accounting

Quickbooks isn’t always the best choice for law firms. Download our whitepaper The Risks of Using QuickBooks for Accounting for tips on how to approach your firm’s accounting and bookkeeping.

Book Balance

Book balance is the amount you show for the IOLTA account on your financial statements. On your balance sheet, this would be reflected as the IOLTA bank account and the associated liability account. Since the IOLTA account is not money belonging to the firm, there should always be a liability account with a balance matching that of the bank account. This will properly reflect the positive and the negative so that the values are not part of the firm value.

The book balance may not match the bank account balance because of uncleared checks or deposits. These may be older items that must be handled or just transactions that have not yet had time to pass through the bank account. The book balance should equal the bank account balance adjusted for uncleared transactions.

Balance by Matter

The balance by matter is just that, a list of how much of the money in the IOLTA account belongs to each client/matter. This should match the book balance. If it doesn’t, you need to know why. The following two main discrepancies can be easily identified and avoided:

- Firm funds deposited into the IOLTA account to handle fees that might be taken from the account

- IOLTA interest deposited one month and removed the next

To avoid these discrepancies, have a firm matter for tracking the funds. In this way, the balance by matter should always equal the book balance unless a mistake has been made.

While it is a good idea for the firm to put a small amount of money into the IOLTA account (bar associations usually have rules on the maximum amount), most banks will set up the IOLTA account so that all fees come out of the firm’s operating account. This minimizes the risk of comingling funds when a client doesn’t have enough money to cover fees.

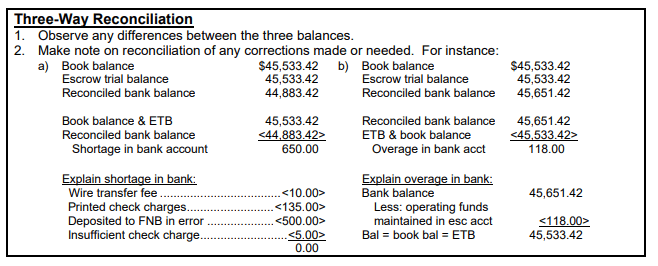

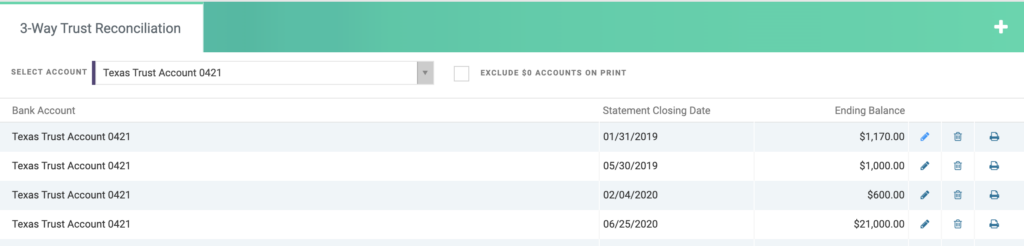

What does a three-way reconciliation report look like?

Your state bar association may have a standard template on its website. One state website shows what is needed with the following example:

What happens if the three numbers don’t match?

If the balances don’t match, you have to investigate to get to the root of the problem. Where to look depends on which accounts are different. For example, if the book balance and the balances by matter match, but the bank account is off, then you might be missing a record of an uncleared transaction or have recorded a payment to trust in your books but mistakenly put the money into the wrong account. It could also be that you put money into the trust account at the bank by accident or intentionally, but forgot to record it in your books and in the matter.

It may take a little detective work, but if you check the three-way reconciliation report each month you will find an issue more easily because you will have a small range to check when there is a problem. Automate your billing and accounting processes to stay on top of it and you’ll have nothing to worry about.

Written by CARET Legal partner, Caren Schwartz. Caren has been serving the technology needs of the legal industry for almost 30 years and leads the accounting services team at 3545 Consulting – Global. Caren’s key focus is back office services, analytics, and best practices for law firms. Caren is the author of QuickBooks for Law Firms.