For all law firms, the flexibility of offering online payments comes with a cost; credit card processing fees. However, there are several strategies that you can employ to offset these costs — one of which is surcharging.

If you’re deciding whether to implement surcharges, keep in mind that there are a number of rules set by credit card companies and your state and local laws that are imperative to be aware of and follow.

Is Surcharging Legal for Law Firms?

Most states allow surcharging, but it is best to check with your state and local laws to verify if adding surcharge fees to credit card transactions is allowed. The decision of whether or not to surcharge falls on each individual law firm. However, one of the most important things to note is that surcharging can only be applied to credit card payments. You cannot add a surcharge to debit card, ACH, prepaid card, or gift card transactions.

Secondly, surcharging is subject to a 3-4% cap rule set by the card brands. This means that the surcharge amount you add to each credit card transaction cannot exceed 3-4% of the total transaction cost. Non-compliance with this rule can lead to penalties and up to $20,000 in fines, or even the loss of your merchant account, which means you’d no longer be able to accept credit card payments at all.

Surcharging in CARET Legal

State and Brand-Specific Credit Card Rules

Federal and state governments, as well as the major credit card brands, are increasingly regulating the practice of surcharging. Below are some of the specific rules around surcharging you should be aware of before implementing them at your firm.

State-Specific Surcharging Rules

There are a few states that have specific surcharging rules and three that do not allow surcharging at all.

No Surcharging Allowed:

- Connecticut

- Massachusetts

- Maine

It is best to consult your local city and state laws to ensure you are compliant with specific surcharging rules.

Brand-Specific Surcharging Rules

In addition to state rules around surcharging, the four major credit card brands have their own surcharging rules as well.

These are some of the most important rules to follow if you’re looking to implement surcharging at your law firm:

- Some credit card companies require firms to notify them 30 days prior to surcharging

- The surcharge can’t exceed the cost of acceptance

- Surcharge disclosures must be provided (online checkout/point of sale)

- The surcharge amount must have its own line item on the transaction receipt

Increasing Billing Rates and Other Alternatives to Surcharging

You may want to consider first, do you actually need to surcharge? Is this the best experience for your clients? There are possible drawbacks when deploying this. For example, as some clients may be sensitive to paying additional fees for using a credit card, it can be ideal to incorporate surcharging fees into your billing rates by 3-4%.

In this example, instead of charging $300/hr, you could increase your rates and charge $310 instead. This pricing strategy inherently covers the processing costs for all clients, regardless of the payment method used.

However, this strategy might not apply to all firms since hourly billing rates can only be applied to operating transactions and can’t be applied to trust account payments.

The best way to make sure your firm stays compliant with the ever-changing rules is to partner with a law firm-specific payment processing solution like APX.

Cash Discounting

Another alternative to surcharging is cash discounting. Unlike surcharging, cash discounting can be applied to all transaction types and involves rewarding the customer with a small discount for not using a credit card and paying with cash, or another form of payment (like ACH) instead.

Keep in mind that there are compliance considerations involved with discounting as well.

- Discounts must be displayed as a line item showing a discount from the full price (firms can show two separate prices, one price for paying with a credit card and another price for cash/direct transfer payments.

- Clients must be clearly notified of the option of a cash discount at the time of payment, inside their signed fee agreement

Currently, there are no state-specific rules around discounting.

Best Practices for Leveraging Surcharges at Your Firm

If you decide to implement surcharges, transparency is key. Choose a payment processing partner that specializes in surcharging and understands the rules and regulations, like CARET’s payment offering, APX.

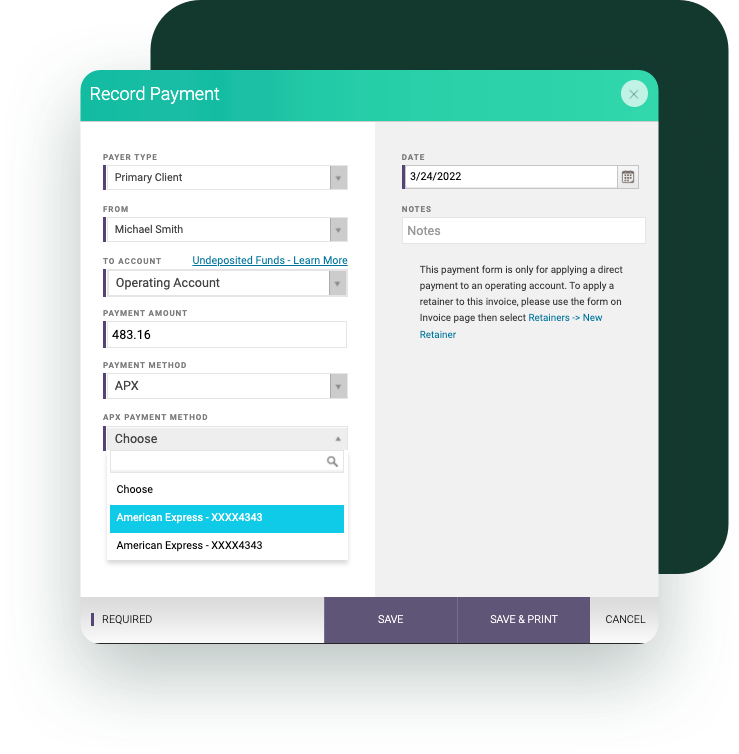

APX, integrated payment processing, within CARET Legal

APX is a fully customizable and transparent service that allows you to choose the amount you want to charge clients and get full visibility into the fees and rates associated with each transaction. We also provide ongoing support and education to ensure that our merchants stay up-to-date with the latest regulations and best practices.

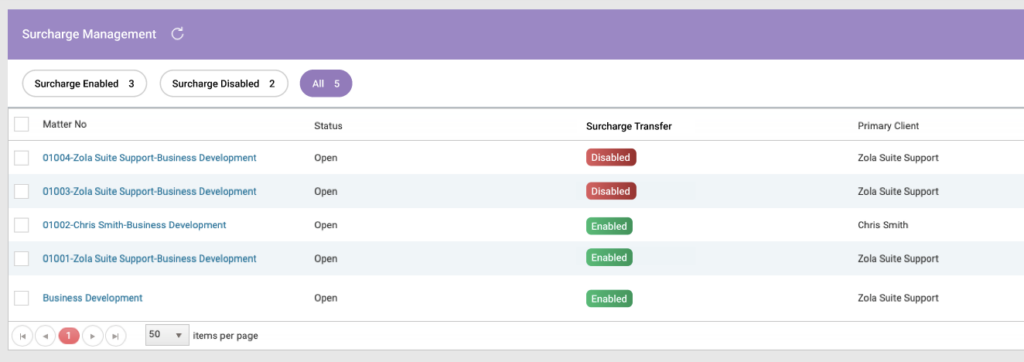

With APX, you can also set up surcharging as default for all invoices and/or manually remove surcharging for select customers.

How to Best Minimize Processing Fees At Your Firm

If you’re a modern law firm that accepts credit card payments, you have to deal with credit card processing fees. Whether it’s surcharging, increasing service rates, or discounting, each method of offsetting these fees has its own set of rules and best practices to follow. The best way to make sure your firm stays compliant with the ever-changing rules is to partner with a law firm-specific payment processing solution like APX.