When vetting both accounting professionals and legal accounting software, having a basic understanding of the key distinctions between general business accounting and legal accounting can be critical to making the right decision for your firm.

Your accountant (or accounting software) may be great at handling small business accounting, but you need to be sure the differences between law firm accounting and other small business accounting requirements are carefully considered. After all, it’s your responsibility to make sure your books are correct.

When vetting both accounting professionals and legal accounting software, having a basic understanding of the key distinctions between general business accounting and legal accounting can be critical to making the right financial decisions for your firm. Let’s dig into some core tenets of legal accounting that can pose unique challenges when it comes to bookkeeping and reporting.

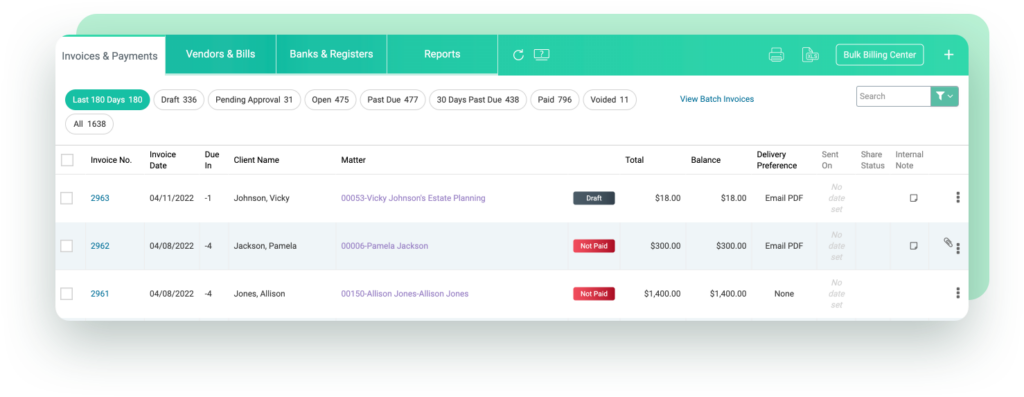

Invoice and payment management in CARET Legal

Cash Basis Accounting vs. Accrual Basis

The first thing to discuss is cash basis vs. accrual basis. According to the American Bar Association (ABA) recommendation, law firms should perform cash basis accounting, which simply means income is recognized when money is received, and expenses are recognized only when paid. This is in contrast to law firm accrual accounting which records revenue and expenses when transactions happen, but before cash is received.

If you are not already filing on a cash basis, be sure to discuss this with an experienced accountant, as there are tax ramifications involved in changing your reporting basis for the IRS.

It gets easier if you’re set up with legal accounting software, like CARET Legal, because you can toggle from cash to accrual basis. This means you can keep track of accounts receivables and accounts payables without impacting your cash basis balance sheet. It’s best to find a platform that allows you to toggle from cash to accrual basis.

Technology Tip:

Often your accountant will want to see accounts receivable and accounts payable. Your billing and/or your accounting software should be able to provide that information for you. If not, the accountant will need to manually create a reversing journal entry at year’s end and January 1.

Cash Basis Account Types

The account types do not change for law firms, but a brief understanding of them will make upcoming recommendations easier to understand.

All accounts appear either on a Balance Sheet or an Income Statement. Here is a simple way to look at things on a cash basis.

- Balance Sheet Account Types

Assets – You Own

Liabilities – You Owe

Equity – What’s Left - Income Statement Account Types

Income – What money you collected

Expenses – What money you paid

Balance sheets are not run for a period of time; they are “as of” a certain date. Income statements run for a date range. At the end of the fiscal year (usually the end of the calendar year), the net income or loss is written to the equity (capital section) of the balance sheet and the new year starts at zero. Remember the income statement zeroes out to understand costs advanced.

The Risks of Using QuickBooks for Accounting

Quickbooks isn’t always the best choice for law firms. Download our whitepaper The Risks of Using QuickBooks for Accounting for tips on how to approach your firm’s accounting and bookkeeping.

Costs Advanced or Client Costs

Now, let’s discuss costs advanced — one of the most significant areas in which law firm accounting differs from that of other service firms. “Costs advanced” are also called “client costs,” and represent your own money used to cover bills on behalf of your clients.

- Hard Costs: payments made externally from an invoice or directly by credit card. They include things like filing fees, overnight delivery service, transcripts, photocopies when using an outside copy company or postage when a separate payment is made for the mailing.

- Soft Costs: charges generally absorbed internally. They include postage through a postage meter, photocopy charges for documents photocopied internally, mileage reimbursement, and faxing.

Often, it can take months for you to get reimbursed for costs advanced. Most accountants expense your costs advanced immediately in the month of outlay. If this occurs, you are not matching the income to the expenses.

Remember when we talked about the income statement and said that the accounts zero out? If you are not reimbursed in the same year, the income statement is closed. For this reason, hard costs advanced should be carried on the balance sheet as an asset to keep them on the books and off your income statement.

The IRS Attorney Audit Technique Guide addresses this issue. Hard costs are carried as assets and are considered loans by the IRS {Rule of IRC §111}. It states:

Courts have determined that costs paid on behalf of a client are to be treated as in the nature of loans for tax purposes. They are not deductible by the attorney as a current cost of conducting business. The costs are those of the client and not the attorney since there is an expectation of reimbursement. A bad debt deduction may be taken in the year that any costs are determined to be uncollectible.

However, attorneys on the cash method of accounting are generally allowed a current deduction for client-reimbursed costs which are allocated to normal operating expenses (for example, secretarial costs or copying costs). These are general office-type expenses that would reasonably be incurred even if not charged to a particular client. Of course, if a current deduction is taken, any subsequent reimbursement from the client would be treated as income in the year of reimbursement under the tax benefit rule of IRC §111. Make sure your bookkeeper understands this.

Note: When you pay hard costs from the client trust funds, they are not considered costs advanced. Remember that costs advanced are only incurred when you advance your money.

Trust Accounting for Lawyers

Trust money is money you are holding in a separate account for a client that does not belong to you.

You cannot commingle this money with your regular operating bank account even if you keep a separate ledger for it.

To keep funds separate, you need to set up a separate bank account for trust funds. There are two types of trust accounts: IOLTA and Escrow. Not all banks are created equal when it comes to trust accounts. Be sure your bank can handle trust accounting properly.

IOLTA Accounts

“IOLTA” stands for Interest on Lawyer Trust Accounts. An IOLTA account is for the deposit of client funds. It pays all interest earned to the Lawyers Trust Fund. Interest generated on IOLTA accounts is an important source of funding for civil legal aid.

Click here to find a directory of IOLTA programs by state to check out specific requirements.

IOLTA programs have taken a leading role in funding innovative programs that have had a positive impact on the delivery of legal services to the poor. These include loan repayment assistance programs, state-based legal information Web sites and legal assistance hotlines. IOLTA programs also fund a variety of other activities including alternative dispute resolution programs, young lawyer special public service projects, victim services programs, court-appointed special advocate (CASA) programs, pro se assistance resources, minority lawyer recruitment initiatives, and law school scholarship programs.

There are many rules around IOLTA accounts and associated transactions. Consider the following:

- No charges not directly attributable to a matter can be made from the IOLTA account.

- Credit card fees should be charged against your operating account and the client’s trust deposit is credited in full in the trust bank account. Make sure your credit card processor can handle this.

- Bank charges like wire transfer fees and stop payments need to be reimbursed by you immediately should these charges occur in your trust account.

Escrow Accounts

Escrow Accounts are interest-bearing accounts. Generally, the money in these accounts is not exclusively for you. They are for funds to be disbursed to other parties — for example, the receipt of funds for the sale of property to be disbursed to your client, the mortgage company and yourself for fees. These interest-bearing trust accounts require that the client receive the interest. You cannot take the interest on this type of account.

When to use IOLTA vs. Escrow

Under ABA Rule 1.15(g), lawyers should exercise reasonable judgment in determining whether client funds should be deposited into an IOLTA account or a separate client trust account. Lawyers should consider three factors in making this decision:

- The amount of interest the funds would earn during the time they are likely to be held

- The cost of establishing and administering a separate account

- The capability of the financial institution to pay net interest to individual clients through the use of sub-accounts

Legal Accounting Software Helps Firms Maintain Compliance

There are certain things to keep in mind when it comes to trust accounting, such as the need to track client ledgers individually while keeping all trust funds pooled in one bank trust account.

Legal-specific accounting software helps safeguard against common mistakes, including:

- Overdrawing the client ledger. Some legal accounting applications prohibit users from generating a trust check for more than the amount in Trust for that Matter.

- Three-way trust reconciliation. All three numbers must match on the trust balance, the trust liability on the balance sheet, and the Client trust ledgers. CARET Legal has a three-way trust report specifically for this purpose.

- Tracking and timing of payment from Trust to Operating when earned. You cannot take your money from the trust account until it is earned and your client has had sufficient time to review the charges. Never issue a refund of retainer until you are sure the funds have cleared the bank (usually 10 days).

- Check stub requirements and confidentiality. Attorneys have the legal obligation to keep matter-related information confidential; this applies to check stubs.

Actionable Tips for Legal Bookkeeping and Accounting

As a matter of course, firms should take the following measures:

- Use different check colors. An Operating check should be easily distinguished from a Trust check. When possible, put the check and stubs in different places so an Operating check can never be printed on a Trust check.

- Use numbers not names. Matter and client number can show on check stubs, but not names on stubs going outside the firm.

- Be detailed with descriptions. When using client funds to pay a vendor, the stub must contain a detailed description or a detailed report attached for your client’s review.

- Allocate partial payments. When a client does not pay you in full, the allocation of the money should be distributed in the following manner until used up:

- Taxes (100%)

- Costs (100% or until used up)

- Fees (generally allocated to timekeepers by pro rata share)

As you can see, there are many differences and considerations when it comes to law firm accounting. It is your professional responsibility to educate yourself and leverage accountant expertise with legal-industry experience when necessary. Specialized legal-specific accounting programs can also help to ensure compliance.

Written by CARET Legal partner, Gerri Martin. Gerri is a Partner with Software Analysis Corporation and a member of Crosspointe Consulting Group, LLC. She holds her undergraduate degree in Accountancy and is a CPA. This gives Gerri the business background needed to understand the financial and management implications of implementing software and business processes.