The introduction of legal trust fund management software has revolutionized the management of these accounts, making the process simpler, more efficient, and less prone to errors.

The introduction of legal trust fund management software has made this process easier, faster and less prone to errors. Managing client funds is a fundamental responsibility of lawyers. Two tools lawyers use to manage these funds are client trust accounts and Interest on Lawyers Trust Accounts (IOLTAs).

The debate of “client trust account vs. IOLTA” is one to understand, as each type of account serves a different purpose and knowing when to use each is important. An attorney trust account, distinct from IOLTA and escrow accounts, is primarily used to safeguard client funds, ensuring they are kept separate from the attorney’s business funds and used only for the client’s benefit. Mismanagement of client funds can lead to severe ethical and legal consequences including disbarment. But the introduction of legal trust fund management software has made this process easier, faster and less prone to errors.

Understanding Client Trust Accounts

A client trust account is a specialized bank account used by law firms to hold client funds separate from the firm’s operating funds. This account is designed to safeguard client funds and ensure that they are managed responsibly. Client trust accounts are essential for maintaining the integrity of the attorney-client relationship and upholding the ethical standards of the legal profession.

Client trust accounts are used to manage various types of client funds, including settlement proceeds, retainer fees, and other payments made on behalf of clients. These accounts are typically interest-bearing, and the interest earned is credited to the client or used to fund legal aid programs, depending on the jurisdiction.

Law firms must follow strict guidelines and regulations when managing client trust accounts, including maintaining accurate records, separating client funds from the firm’s operating funds, and ensuring that client funds are not commingled with the firm’s money.

When to Use Client Trust Accounts

A client trust account is the best option when you need to hold a large amount of a client’s funds for a long time. This could be when a lawyer is holding a large settlement amount on behalf of a client or when a client’s funds are to be held in escrow during a property transaction. In such cases the funds are placed in a client trust account where they can earn interest over time. The interest earned from these funds is then credited to the client. By using a client trust account in such scenarios, lawyers ensure that client’s money is handled ethically and legally and uphold the trust and confidence the client has in them.

However managing a client trust account requires attention to detail. Lawyers must keep accurate records of all transactions, maintain separate ledgers for each client and reconcile the account regularly to ensure all funds are accounted for. This can be time consuming and complicated but is part of maintaining ethical and legal practices.

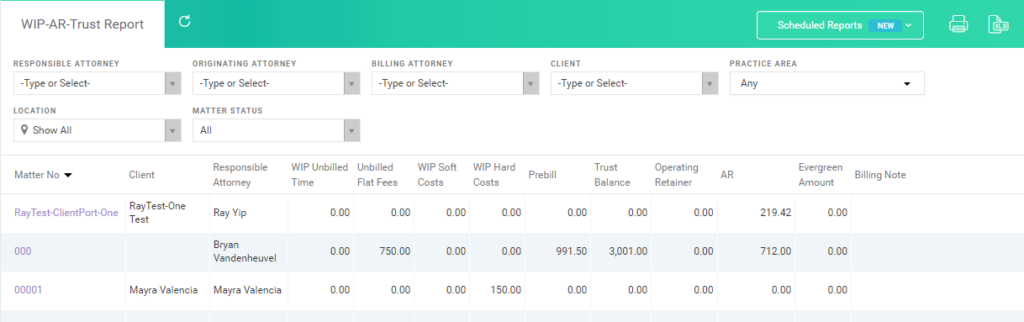

Work in Progress – AR – Trust report in CARET Legal

But legal practice management software like CARET Legal with trust fund management capabilities can ease the burden. CARET Legal automates record-keeping, simplifies reconciliation and reduces the risk of errors. It also gives you a clear view of the client’s funds so you can make informed decisions on when to use a client trust account vs IOLTA. By analyzing the size and duration of the funds, calculating the interest and considering the administrative costs the software helps you choose the right and most beneficial account type for your client.

State Bar Regulations for Trust Accounts

State bar associations regulate the management of client trust accounts to make sure that law firms comply with ethical standards and protect client funds. These regulations vary by state, but they typically require law firms to:

- Maintain separate trust accounts for client funds

- Keep accurate records of client transactions

- Separate client funds from the firm’s operating funds

- Ensure that client funds are not commingled with the firm’s money

- Provide regular accounting to clients

- Undergo periodic audits to verify compliance

Law firms must familiarize themselves with the specific regulations in their jurisdiction to comply with all requirements. Failure to comply with state bar regulations can result in disciplinary action, including fines, suspension, or disbarment.

The Risks of Using QuickBooks for Accounting

Quickbooks isn’t always the best choice for law firms. Download our whitepaper The Risks of Using QuickBooks for Accounting for tips on how to approach your firm’s accounting and bookkeeping.

Handling Interest on Lawyers Trust Accounts (IOLTAs)

An Interest on Lawyers Trust Account (IOLTA) is best used for situations where smaller amounts of funds will be held for a short period in an IOLTA account. This is because the cost and administrative burden of setting up and maintaining a separate interest-bearing account for each client would exceed the interest earned from such small amounts or short durations.

CARET Legal makes sure you stay compliant with ABA and IOLTA guidelines.

The interest earned from an IOLTA is not credited to the client. Instead it is pooled together and used to fund legal aid programs for underprivileged individuals who cannot afford legal services. So using an IOLTA not only ensures ethical handling of client funds but also contributes to a greater cause by supporting access to legal services for those in need.

Managing an IOLTA also requires careful record-keeping and regular reconciliation. You need to track each client’s funds separately, ensure client funds are not mixed with firm’s funds and confirm that the total of individual client ledgers matches the total balance of the IOLTA. This is where legal trust accounting software can be a game-changer. It automates these tasks and ensures accurate and efficient management of IOLTA accounts. Moreover it helps you decide when to use an IOLTA by analyzing the size and duration of the funds and comparing it with the potential costs and benefits of using a client trust account.

Legal trust accounting software assists in deciding when to use an IOLTA by analyzing the size and duration of the funds and comparing it with the potential costs and benefits of using a client trust account.

Ready to Make Informed Decisions?

Using a client trust account or IOLTA becomes easy with legal practice management software like CARET Legal. It simplifies account management and decision making by allowing you to manage and analyze funds, calculate interest and administrative costs. It’s not just software – it’s a trusted partner for law firms in the client trust account vs IOLTA debate.

Schedule a demo today and let CARET Legal reshape your approach to managing client funds.