With a thoughtful approach and the right financial solutions, law firms can not only survive these slower periods but thrive, ensuring consistent cash flow and financial stability year-round.

Most businesses keenly understand the ebb and flow of seasonal cycles. Service companies like air conditioning contractors, vacation travel firms, resorts and airlines see peak business during the hot summer months, while many retailers tend to see their busiest season right around the holidays and tax attorneys and accountants see peaks around tax filing deadlines.

A summer slowdown happens in many industries, including legal services. During the summer months, more than half of Americans take days off. During this time, collections may taper off while your clients’ accounting staff is on vacation. This phenomenon works in the other direction as well – customer payments can be delayed or slowed when the firm’s collection activity decreases while team members are out of the office.

Let’s explore various reasons why your law firm might be experiencing slow payments related to seasonality and the steps you can take to remove these barriers and improve summer cash flow with CARET Payments.

Seasonal Business and Vacation Time

When it’s your clients’ slow season, they might delay paying invoices, thus affecting your law firm’s cash flow. Similarly, employees on vacation might cause payables to lag as they might not process payments before leaving.

Automating your payment process with CARET Payments helps address these challenges. This system can be accessed remotely, allowing for one-click payments no matter where your clients or their employees are. It offers a “Pay Now” link that can be emailed to a client or accessed online in the CARET Caseway secure portal.

Clients love the PayNow link! They can pay with just one click. As a result, 75% of clients pay the same day they receive an invoice.

Manual, Legacy or Poor Payment Processes

Some businesses might still be relying on legacy accounting systems that aren’t integrated with orders or other aspects of their operations. If the payment process is manual or paper-based, it becomes time-intensive and may not be easily handled by a substitute employee during vacation time.

Transitioning to CARET Payments means automating your payments, resulting in a much more streamlined and efficient process. It eliminates the need for physical paperwork and paper checks, allowing for faster payments and improved cash flow.

Clients Treating Firms Like Banks

Sometimes clients might treat vendors – including law firms – like banks, stretching out payments beyond the due date and slowing down cash flow.

By adopting clear policies and offering early payment or on-time payment discounts, customizable billing or installment payments, you can reinforce to clients that everyone benefits when payments arrive on time. CARET Payments also provides automatic reminders to clients, helping to prompt payment before due dates.

Payment preferences vary among clients. Whether they prefer credit card, debit card or ACH, the more payment methods your firm offers, the greater likelihood that clients will pay on time.

Lack of Variety in Payment Options

Payment preferences vary among clients. Whether they prefer credit card, debit card or ACH, the more payment methods your firm offers, the greater likelihood that clients will pay on time.

CARET Payments offers flex billing, accommodating various payment preferences, including ACH, credit or debit cards. This allows your clients to choose the payment method that suits them best.

High Merchant Fees

High merchant fees can deter clients from using certain payment methods. This can result in slower payment processes and an impact on your cash flow.

With CARET Payments, the savings from manual check processing costs are typically greater than merchant processing fees. This reduces the cost for clients, making payments more appealing and swifter.

When clients do choose automated payment with CARET, they pay some of the lowest fees available. Your firm has the option to offset or absorb the fee to accommodate particular clients.

Managing Seasonality with CARET Payments

CARET Payments can be a game-changer in managing the seasonality in accounts receivable. It’s a suite of financial solutions designed to streamline the payment process and improve cash flow. Here’s how your law firm can leverage CARET Payments to navigate seasonal slowdowns:

- Flexible Payment Options: With CARET Payments, law firms can offer clients a variety of payment options such as credit cards, ACH transfers or payment plans. This flexibility can encourage clients to settle their invoices in a timely manner, even during slower months.

- Automated Billing: By automating the billing process, law firms can ensure that invoices are sent out promptly and consistently, reducing the chances of delayed payments. Automated reminders can also be used to nudge clients who might be slow to pay.

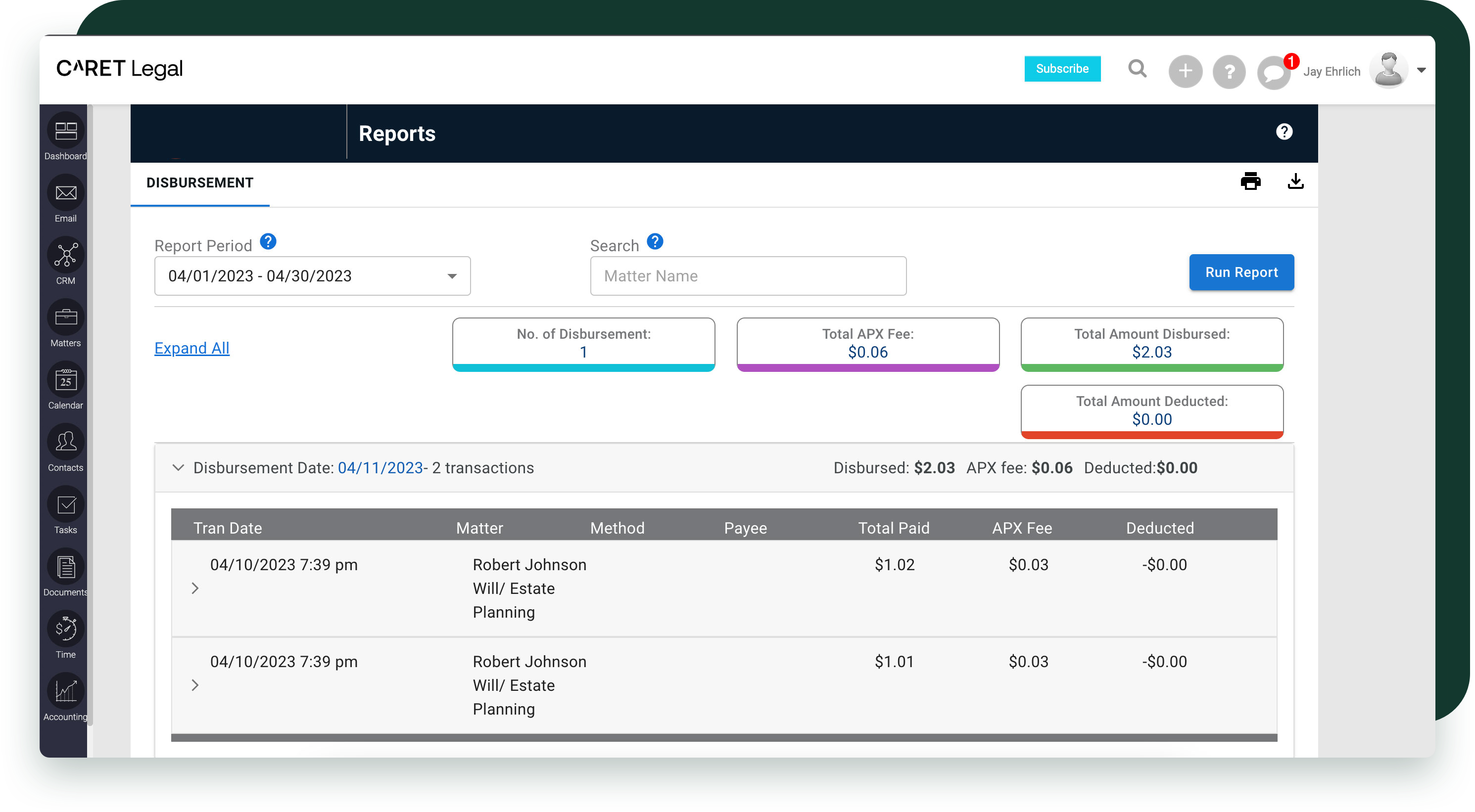

- Cash Flow Reporting: Utilizing cash flow reporting tools provided by CARET – including the AR Aging Summary Report, which collects the total amount of unpaid invoices grouped by matter, client and various levels of delinquency, and the Statement of Account Report, which lists invoices and payments by matter and client – law firms can anticipate seasonal slowdowns and plan accordingly. These tools can provide insights into when the firm might experience cash flow challenges, allowing for proactive measures to be taken.

- Custom Reporting: The CARET professional services team can easily develop custom reports tailored to your specific needs and is always just a phone call away.

The key to managing seasonality is understanding and anticipating the fluctuations. With a thoughtful approach and the right financial solutions, law firms can not only survive these slower periods but thrive, ensuring consistent cash flow and financial stability year-round.

Maintaining a healthy cash flow is crucial for the smooth running of your law firm. By addressing the above reasons for slow payments and implementing CARET Payments, you can ensure receivables still come in at a steady pace, even during the slow summer months.

For more information about our automated payments system, check out the resources on CARET Legal’s billing and payments page.

If you need any more reasons to consider automated payments, be sure to read our blog post on The Risks of Mailing Checks. (And share it with your clients!)

Embrace the future of legal payments with CARET. Keep your cash flow strong, irrespective of the season or the reason. For an in-depth understanding of the time-saving benefits of CARET Payments, explore our case study on Wright Law LLC.

New to legal practice management? See how CARET Legal can help with cash flow and much, much more. Get a free trial of CARET Legal today.