Keeping a close eye on expenses isn’t just good business—it’s essential for success in insurance defense law, where profit margins are notoriously tight.

Insurance defense firms face intense pressure to deliver results while controlling litigation costs. From expert witness fees to deposition expenses, even minor budget overruns can erode slim profit margins. In this article, we explore how modern legal practice management software helps insurance defense attorneys track expenses, streamline workflows, and maintain strong client relationships.

Why Precise Cost Tracking Matters in Insurance Defense

Insurance defense firms often operate within narrow margins, which makes accurate financial oversight a practical necessity. Consider a defense attorney handling a slip-and-fall case. While focusing on strategy, they lose track of rising expenses for depositions and expert witnesses. By the time invoices are prepared, the case has exceeded its budget. This creates tension with the client and reduces profitability.

Carriers expect consistent billing that stays within agreed limits. Budget overruns can cause frustration, erode trust, and jeopardize long-term partnerships.

Real-time visibility into expenses helps attorneys make informed decisions throughout the litigation process. They may adjust vendor selection, limit depositions, or shift tactics without compromising the defense. This level of awareness also supports clearer communication with clients, giving them timely updates and improving financial alignment.

Firms that maintain control over litigation costs while delivering strong legal outcomes are more likely to retain carrier confidence. Reliable cost tracking supports consistent results, transparent billing, and lasting client relationships.

Leveraging Technology for Real-Time Cost Insights

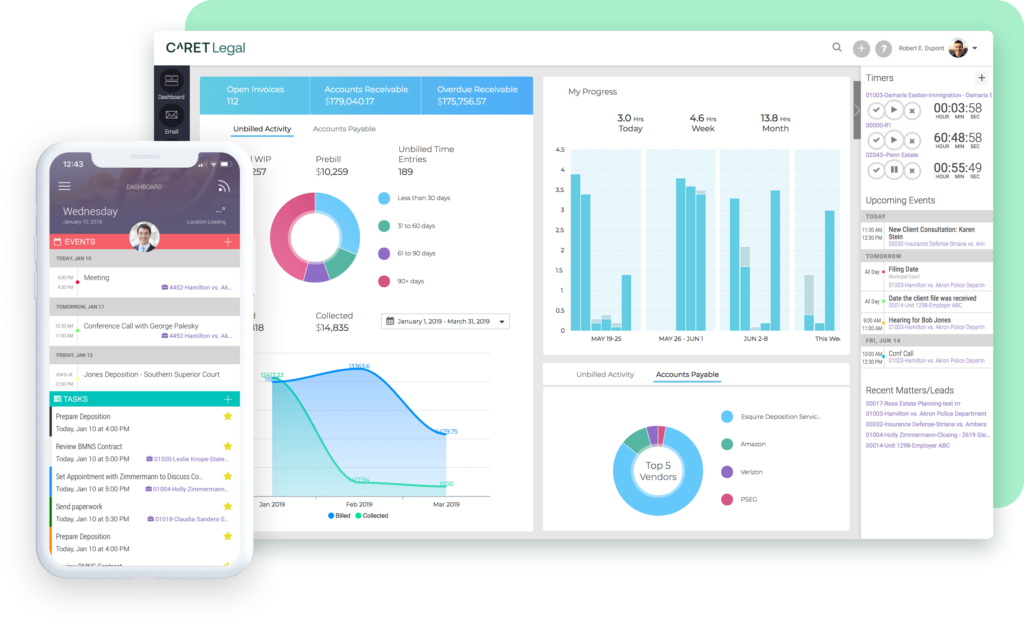

Modern technology has revolutionized the way insurance defense attorneys can track and manage litigation costs. Advanced legal practice management software, such as CARET Legal, provides real-time visibility into case expenses, transforming what was once a laborious process into a streamlined, data-driven approach.

Modern cost-tracking features include:

- Automated Expense Capture: Automatically record and categorize expenses as they occur, reducing manual data entry and the risk of oversight.

- Real-Time Dashboard: View up-to-date cost information for each case at a glance, allowing for quick decision-making and proactive cost management.

- Detailed Reporting: Generate comprehensive reports on costs across cases, clients, or specific expense categories to identify trends and opportunities for optimization.

- Integration with Case Management Systems: Seamlessly connect cost data with other case information for a holistic view of each matter.

Legal practice management solutions reduce the manual effort of tracking costs, allowing attorneys to focus on crafting solid defenses and motion practice without losing sight of the budget. By providing instant access to financial data, these tools empower attorneys to make informed decisions about resource allocation and case strategy in real time, a crucial advantage in the fast-paced world of insurance defense.

Legal practice management solutions reduce the manual effort of tracking costs, allowing attorneys to focus on crafting solid defenses and motion practice without losing sight of the budget.

| Feature | Manual Tracking Methods | CARET Legal Solution |

| Expense Capture | Manual entry, high error risk | Automated, categorized in real time |

| Team Collaboration | Email updates, spreadsheets | Built-in client collaboration tools |

| Report Generation | Time-consuming, inconsistent | One-click detailed reporting |

| Carrier Compliance | Manually checked guidelines | Built-in compliance measures |

| Integration with Case Data | Not integrated | Fully integrated with case files |

Implementing Cost-Control Tactics in High-Volume Cases

Balancing cost-effectiveness with high-quality representation is a constant challenge in insurance defense, especially when managing a large caseload. The key lies in implementing smart, scalable tactics that control expenses across multiple cases while delivering excellent legal services. Let’s explore some practical approaches that can help defense attorneys optimize their operations and maintain healthy profit margins:

- Set Clear Billing Standards: Establish and communicate clear guidelines for billable activities, ensuring consistency across all cases and alignment with carrier billing guidelines.

- Regular Vendor Review: Periodically assess common expenses like court reporting or expert witness fees to ensure you’re getting competitive rates. Consider negotiating volume discounts with frequently used vendors.

- Utilize Data for Budgeting: Use historical cost data to create more accurate budgets for similar case types, improving your ability to provide reliable litigation budgets to carriers.

- Strategic Use of Support Staff: Optimize the use of paralegals and legal assistants for tasks that don’t require attorney-level expertise. For example, have paralegals handle initial document review or draft routine motions, reducing overall costs while maintaining case quality through attorney supervision.

- Embrace Technology: Invest in tools that automate routine tasks, such as document assembly or e-discovery platforms, reducing billable hours spent on administrative work.

- Implement Project Management Techniques: Apply project management principles to litigation, setting clear milestones and budgets for each phase of a case. This approach can help identify potential cost overruns early in the litigation process.

By implementing these tactics, insurance defense firms can maintain tight control over costs even in high-volume practices. The key is to create systems and processes that make cost management an integral part of case handling, rather than an afterthought.

Communicating with Clients About Costs in Real Time

Transparent and timely communication about costs is crucial for maintaining strong client relationships in insurance defense. Real-time cost insights enable attorneys to keep clients informed and aligned on financial expectations throughout the litigation process.

Effective cost communication strategies include:

- Regular Cost Updates: Provide clients with periodic updates on case expenses, highlighting any significant changes or unexpected costs. For instance, if a case unexpectedly requires additional expert testimony, promptly inform the carrier and discuss the impact on the overall budget.

- Proactive Budget Discussions: Use real-time data to have informed discussions about budgets, addressing potential overruns before they become issues. For example, if discovery is more extensive than initially anticipated, initiate a conversation about adjusting the budget rather than surprising the client later.

- Customized Reporting: Offer clients tailored reports that align with their specific needs and preferences for financial oversight. Some carriers might prefer detailed monthly breakdowns, while others might want quarterly summaries with year-to-date totals.

- Collaborative Cost Management: Involve clients in key decisions that may impact costs, fostering a sense of partnership in managing expenses. This could include discussing the cost-benefit analysis of pursuing certain motions or settlement strategies.

- Transparent Billing Practices: Ensure that all bills are clear, detailed, and align with the real-time cost data shared throughout the case. Use task-based billing codes when required by carriers to provide granular insight into how time is being spent.

By maintaining open lines of communication about costs, attorneys can build trust, minimize billing disputes, and demonstrate their commitment to cost-effective representation. This transparency not only satisfies carriers’ need for predictable legal expenses but also positions the firm as a valuable partner in managing overall claim costs.

Mastering Cost Management for Success in Insurance Defense

For insurance defense firms, effective cost management isn’t just about maintaining profitability—it’s about becoming a preferred partner for carriers. In an industry where margins are tight and competition is fierce, your ability to control costs while delivering superior legal services can set you apart from the crowd.

By adopting advanced tracking tools, refining your cost-control strategies, and prioritizing financial transparency, you can position your firm as a leader in efficient, high-quality defense. This approach not only satisfies carriers’ demands for predictable legal spend but also demonstrates your commitment to aligning your interests with theirs.

CARET Legal is designed to help insurance defense attorneys excel in this challenging environment. Our platform offers the real-time insights and streamlined processes you need to master the financial aspects of your practice. From automated cost tracking to customized client reporting, CARET Legal provides the tools to turn your cost management into a powerful competitive advantage.

Ready to see the difference? Book a free demo of CARET Legal today and discover how you can transform your approach to litigation expenses.

Frequently Asked Questions

Question: What time-saving techniques can litigation firms use to improve case management?

Answer: Litigation firms can save time by centralizing case information with practice management software, automating court calendaring, improving document organization, and using secure collaboration tools to reduce back-and-forth communication.

Question: How does organized document management help attorneys save time during litigation?

Answer: Efficient document management allows attorneys to quickly locate, review, and share files without delays. When files are digitized and indexed properly, teams spend less time searching for information and more time focusing on legal work.Question: Why is automating court scheduling important for litigation practices?

Answer: Automating court scheduling reduces the risk of missed deadlines and eliminates the need for manual calendar updates. This keeps the entire legal team aligned on important dates and supports better case planning.