It is important for all businesses, especially law firms, to control operating expenses.

The goal of all law firms is to be profitable, but achieving that goal can be difficult for some lawyers. Generating income is, obviously, the first step towards making a profit; of course, income can only be generated if billable hours are accurately recorded and invoiced to clients, and if payments for those invoices are collected. Moreover, all firms, no matter their size, must spend money to make a profit. The transactions of money flowing out of the firm are recorded as expenses in the firm’s accounting system. Profit is determined by the amount of income that exceeds a company’s expenses incurred to generate the income itself. Therefore, it is important for all businesses, especially law firms, to control operating expenses, which in turn requires timely and accurate accounting, organization and analysis of financial information.

Types of Expenses

Law firms traditionally incur two types of expenses: (1) expenses incurred on behalf of, or to provide services directly related to, the client for a specific matter and (2) overhead expenses, also known as general operating expenses. The former, which should be billed back to the client, is dependent on the volume and type of services a firm provides to their clients. Overhead expenses, on the other hand, include all costs of running a firm, independent of whether the firm has any active cases or even clients. These expenses are either fixed (such as insurance, equipment and rent) or variable (such as electricity, payroll and office supplies). Fixed expenses are static and mostly remain the same from month to month, but variable expenses will vary based on the volume of services the firm performs in any given month.

A good legal accounting system will provide a method to record expenses incurred on behalf of, or to provide services directly related to, a client. When billed for these costs, the client reimburses the firm for these expenses to offset their effect on overall profit. There are two types of billable client costs: hard costs and soft costs. The former are costs resulting from a payment by the firm in the form of a check or credit card transaction, meaning money is expended. Soft costs are typically the recovery overhead charges for specific client-related services, such as in-house photocopies or postage. Whether a law firm chooses to recover soft costs varies by firm. However, both must be identified, recorded and allocated to a client to be sure the firm is being reimbursed appropriately. As stated before, all client expenses should be billed in a timely manner to ensure full reimbursement.

Client Costs

Client costs that are not reimbursed by clients should be recorded as such in the firm’s accounting system. Therefore, the client costs that are not reimbursable should be recorded separately from those that are collectable. Non-billable costs should be analyzed regularly to determine why they are non-collectible and lawyers should be aware of these costs and take great effort to reduce the amount of non-collectible client costs. Implementing procedures specifying the types and amounts of client costs that can be incurred on behalf of a client with or without approvals will assist the firm in their efforts to control client costs. Some firms require client approval before any costs can be incurred, where others set unique threshold amounts and anything above that amount requires approval, but anything below does not.

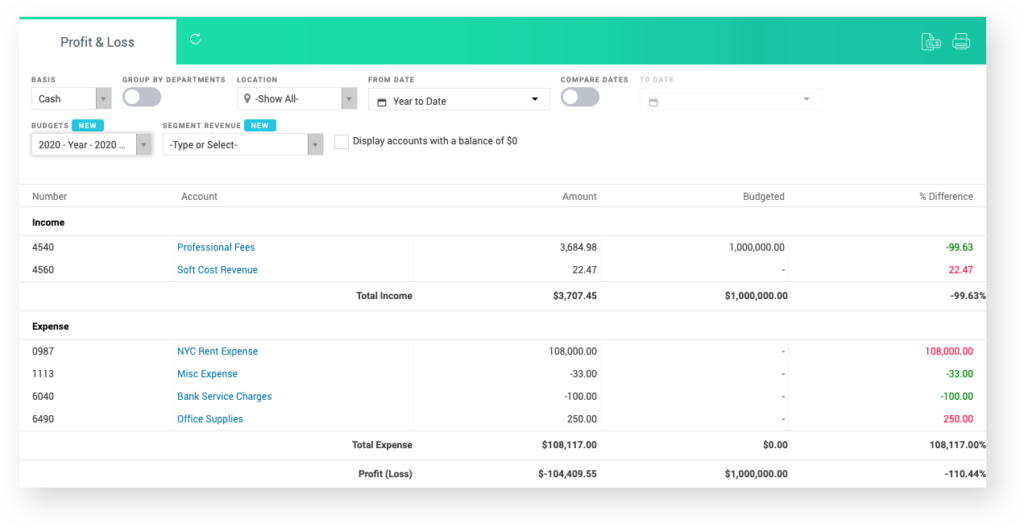

Analyzing monthly performance and comparing actual spending to budgeted amounts, gives the firm the ability to identify and control expenses.

Overhead Expenses

Overhead expenses are expenses that are not directly associated with the client work. Typically, the largest non-client related expense in a law firm is salaries and benefits paid to the firm’s employees. Because this is the largest single expense for a law firm, employees’ time billed and collected should be evaluated periodically to ensure employees are productive and the fees they are deriving are exceeding the amount the employee is being compensated.

Other overhead expenses can include rent, insurance, office equipment, and utilities. As noted before, many of these are fixed costs because regardless of income fluctuations they are the same from month to month or year to year.. Timely bank reconciliations completed by someone other than the person writing checks or recording deposits is the simplest way to implement internal controls and ensure all funds are accounted for and properly allocated to the proper expense category. In-house fraud is, unfortunately, a very frequent drain on a firm’s finances and bank reconciliations identify fraud while ensuring all funds are accounted for properly.

Controlling Costs and Spending

One of the most effective ways of controlling costs is to analyze monthly accounting reports that are generated through the firm’s accounting system. The income statement, or profit and loss (P&L) statement, is the best report to analyze incurred expenses. Frequent review and analysis of this report gives firms the ability to understand the revenue and spending trends on a month-to-month basis. These trends, and subsequent analysis, should include budget comparisons. Creating a monthly budget based on prior expenditures, or known contracted expenses, is the best way to evaluate the firm’s actual spending. To do this, the firm should compare the actual amount spent on expenses to the budgeted amount so variances can be identified before it is too late, and they become uncontrollable.

Analyzing monthly performance and comparing actual spending to budgeted amounts, gives the firm the ability to identify and control expenses. Spending can and should be adjusted based on monthly variances, because waiting until the end of the fiscal year is too late to make any effective change. Controls on expenses can be implemented in several ways, including requiring partner approval for expenditures over a certain amount, to ensure expenses have been budgeted for and approved by the leadership of the firm.

A law firm’s profit is dependent on many factors, and collected revenue is the foundation of a firm’s financial stability. Overspending can easily eradicate that foundation, so it is important to control expenses to maintain profitability. Implementing controls and procedures, also known as internal controls, can assist a law firm in accurately recording and understanding its financial picture and, hopefully, maintain and increase its profit from year-to-year.

Written by CARET Legal partner, Deborah J. Schaefer. Deborah is a Certified Public Accountant in Connecticut and New York, who specializes in the selection, implementation, training, and support of computer-based accounting systems for law firms. Practicing for over 35 years, she has worked with hundreds of firms across the US and internationally.