Although it is very comforting to carry large bank balances, this represents very little about a law firm’s profitability or financial health.

The financial health of a law firm is ascertained by analyzing and evaluating many different pieces of information. Law firms, like many other businesses, sometimes evaluate their success based on the amount of money they have in the bank. Although it is very comforting to carry large bank balances, this represents very little about a law firm’s profitability or financial health. The net profit of a law firm is one very important factor used in determining financial stability; however, here are several other pieces of information that should be reviewed consistently to control and assess the financial strength of a law firm.

Income Statement (or Profit and Loss Statement)

The most obvious report used to determine profitability is the income statement or profit and loss statement. The income statement reports on the firm’s operations for a specific time frame during the fiscal or accounting year. This report will present the fees earned and the firm overhead expenses paid. The impact of client costs will vary by law firm.

Some law firms classify client costs as an expense offset by any client costs recovered from clients. This account is part of the income statement. Other law firms will classify client costs as a receivable. In this scenario, the client costs are not part of the income statement but are reported as an asset on the balance sheet. For a firm that classifies client costs as a receivable, the only client costs that will show on an income statement are those costs that cannot be recovered from a client.

The income statement reports the financial performance for the current month and the current year to date. Many firms find it very valuable to compare one month during the last year to the same month in the current year, as well as this year to date compared with last year to the same date. Creating a yearly and monthly budget for income and overhead expenses can be very useful. The comparisons of actual to budgeted amounts enables the law firm to adjust spending when unusual and unexpected income variations or expenditures are identified. Reviewing the income statement frequently enables management to make decisions that will have the most favorable impact on the firm’s finances.

Balance Sheet

The second financial report to be reviewed monthly is the balance sheet. This report provides a snapshot of what the law firm owns and owes, as well as the amount invested by shareholders. The balance sheet details how much money is in the bank and the value of the firm’s investment in furniture, fixture and leasehold improvements. The report also details how much money the firm owes in bank loans, line of credit or unpaid expenses. The final section of the balance sheet details how much money is invested in the firm as a result of capital contributions or undistributed profits from the prior year. The financial health of a firm takes into consideration whether the firm’s fee income will be adequate to pay the overhead costs and the pay back of any outstanding loans.

The information presented on the income statement and the balance sheet represent the financial position of the firm as of the day of the report. How can a law firm determine if its finances will stay consistent over time? The financial operations of a law firm can vary month by month. The objective is to manage the income so that the cash flow is consistent. Keeping the accounts receivable current is the best way to control collections.

An accounts receivable report reflects the amount that clients have been billed but have not yet paid. This report is traditionally presented with the ages of the client invoices not yet paid. The more current an invoice, the greater the chance that the firm will be paid. Any client invoices that are outstanding 90 days or more are far less likely to be collected. Lawyers should review their receivables monthly and actively contact clients to try to collect outstanding invoices on a timely basis.

CARET Legal offers robust financial management tools and 28 single-click reports that deliver real-time insights into your firm’s productivity and profitability.

Accounts Payable

The accounts payable should also be reviewed every month. This report details the amounts the firm owes. Any outstanding overhead expenses will be reflected in the accounts payable report. Some firms will not pay client costs until they are recovered by the client and those amounts are reported. The future cash flow of the law firm is determined by the amount in receivable, less the amount in payables. The net cash flow is important financial information that needs to be considered when evaluating the firm’s overall financial health.

Work in Process

Another important financial indicator is found in unbilled time and expenses, or work in process. Many studies have shown that the sooner you bill fees and costs, the sooner the lawyer is paid and the greater the probability of collecting these fees and costs. As time passes, the client may forget or become less familiar with the work and therefore not pay. The typical time required to collect fees is 30 – 90 days after the work was performed.

Timekeeper Productivity and Matter Profitability

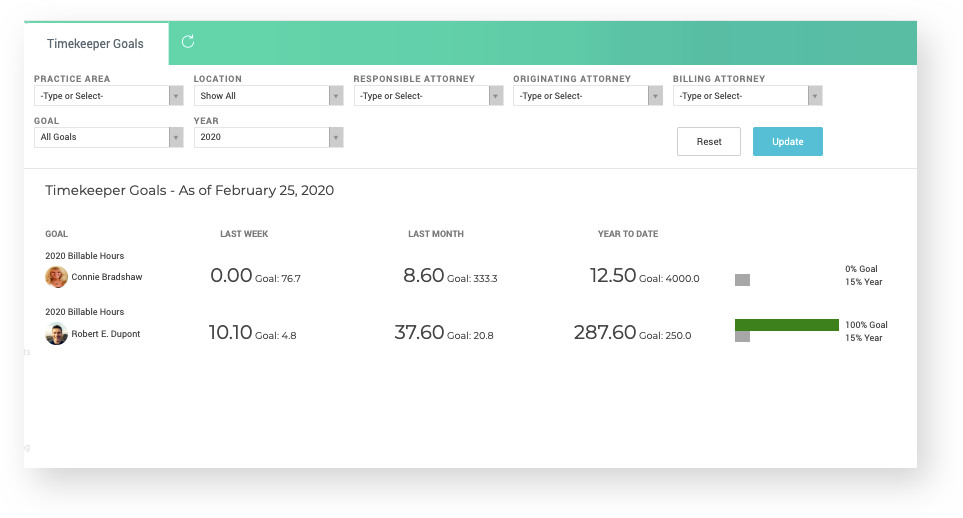

The reports discussed so far track the money that flows through the firm. Understanding how the money is being earned by timekeeper and matter is another very important part of understanding the financial health of a law firm. A report that shows how much time each timekeeper has recorded, both billable and non-billable, will illustrate the timekeeper productivity. Billable time worked should be tracked to determine the percentage of the actual work that is billed.

Firms will in some cases reduce what has been billed or provide a discount to the client. These functions reduce the effective rate of the timekeeper. The effective timekeeper rate should be evaluated on a periodic basis to ensure that the timekeepers are billing enough revenue to fund their salaries and benefits. Creating budgets for each timekeeper based on the number of billable hours and revenues provides an important matrix to use for evaluation. Associates and partners should be evaluated on a consistent basis to ensure they are producing enough revenue.

Matter profitability should be considered when analyzing a law firm’s financial health. Knowing the source of revenue will indicate whether the firm is showing profit because of just one large case or many different profitable cases. If the firm is taking on work that is not profitable, this should be identified and evaluated. Matter profitability should be analyzed by the area of practice, responsible attorney and working timekeepers. Identifying reasons for lost productivity and profitability can assist in identifying and resolving underlying issues. Perhaps there are strengths and weaknesses of timekeepers that can be taken into consideration when assigning work. New business that is presented to the firm should be evaluated by measuring previous mater profitability for the same types of cases.

There are many factors that contribute to the financial health of a firm. Consistent monthly review of performance and legal accounting reports will enable a firm to react in a timely and responsible manner. Planning and anticipating changes in a firm’s revenue is going to provide the management team with the tools they need to control their bottom-line profitability and financial health. Management can then make hiring and spending adjustments based on performance rather than guesswork. Understanding the data on the reports presented and their effects will assist in increasing profits and maintaining overall financial stability.

Written by CARET Legal partner, Deborah J. Schaefer. Deborah is a Certified Public Accountant in Connecticut and New York, who specializes in the selection, implementation, training, and support of computer-based accounting systems for law firms. Practicing for over 35 years, she has worked with hundreds of firms across the US and internationally.